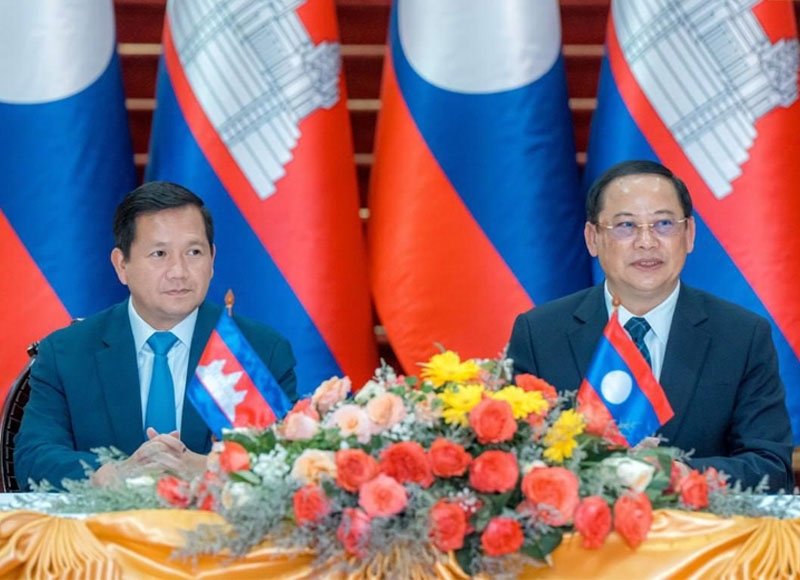

Cambodia and Laos strengthen bilateral trade and investment ties

| News Highlights |

Economy and Industry

Cambodia and Laos strengthen bilateral trade and investment ties Cambodia and Laos are advancing bilateral cooperation in key sectors such as trade, tourism, energy, finance, and infrastructure. During discussions at the ASEAN Summits in Vientiane, Prime Ministers Hun Manet and Sonexay Siphandone focused on finalizing a double taxation agreement and expanding cooperation in areas like border infrastructure to facilitate trade and tourism. They also emphasized the importance of energy security and green energy initiatives through the ASEAN Power Grid. The leaders expressed a joint commitment to boosting economic ties and strengthening political, defense, and security cooperation. Both countries aim to foster regional development and stability, aligning their efforts with broader initiatives like China's Belt and Road Initiative (BRI), which connects them through transportation networks and economic collaboration. (Source: Khmer Times)

Vietnam imports $1B in Cambodian cashews In the first seven months of 2024, Vietnam imported $1 billion worth of raw cashews from Cambodia, accounting for 95% of Cambodia's cashew output. Despite the increase, market experts expect a decline as Cambodia ramps up its domestic cashew processing, targeting 25% by 2027 under its National Cashew Policy. This shift could challenge Vietnam's cashew industry, which heavily relies on imports, prompting calls for Vietnamese companies to invest in Cambodian processing plants to sustain their export capacity. Cambodia's focus on value-added agriculture aims to boost economic returns and create jobs. (Source: Khmer Times)

Vocational training programs see over 80,000 enrollments Between November 2023 and early October 2024, over 80,000 young people enrolled in vocational training programs launched by Cambodia's Ministry of Labor and Vocational Training (MLVT). Of the 80,594 participants, 32,059 were women, and more than 10,000 graduates have already secured jobs or internships. The initiative aims to develop a skilled workforce to meet Cambodia's growing economic and technological demands. The program promotes various fields, including construction, mechanics, IT, and tourism, and has collaborated with private sector associations to offer practical training opportunities. (Source: Khmer Times)

Corporate News

MIRARTH expands cashew processing and explores biomass fuel production in Cambodia Japan's MIRARTH Green Tech has expanded its cashew nut processing capacity in Cambodia to 1,500 tonnes annually, a substantial increase from its initial 3 tonnes in 2021, according to a meeting with the Ministry of Industry, Science, Technology & Innovation (MISTI). The company is also studying the potential of producing biomass fuel from cashew nut shells and trees, a project anticipated to take two years. MIRARTH has sought MISTI's assistance in meeting standards and analysing nutrition facts for its cashew products. MISTI pledged continued support in overcoming challenges and exploring business expansion opportunities. (Source: Khmer Times)

Stock Market

CSX index sees slight gain with mixed stock performance On October 10, 2024, the CSX index edged up by 0.15%, closing at 411.1 points. Among the main board stocks, PPAP (+0.45%) and CGSM (+0.41%) posted gains, while PWSA (-0.62%) and PPSP (-0.45%) declined. GTI, PAS, ABC, PEPC, MJQE, and CGSM remained unchanged. On the growth board, DBDE held steady, but JSL fell by 0.29%. Total trading volume reached 29,939 shares, with a trading value of KHR 182 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 411.13 | 0.15 | 29,939 | 11,027 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 6,400 | -0.62 | -1.54 | -12.09 | 6,760 | 6,400 | 38,543 | 557 |

| GTI | 4,080 | 0.00 | 0.49 | 43.66 | 4,080 | 3,790 | 33,527 | 163 |

| PPAP | 13,360 | 0.45 | 1.21 | -4.57 | 13,900 | 13,200 | 2,801 | 276 |

| PPSP | 2,220 | -0.45 | 0.45 | 1.83 | 2,240 | 2,210 | 23,899 | 160 |

| PAS | 11,480 | 0.00 | -3.37 | -8.74 | 11,920 | 11,380 | 31,423 | 985 |

| ABC | 7,480 | 0.00 | 0.00 | -25.65 | 7,500 | 7,480 | 111,040 | 3,240 |

| PEPC | 2,430 | 0.00 | -0.82 | -11.31 | 2,500 | 2,410 | 2,640 | 182 |

| MJQE | 2,050 | 0.00 | 0.49 | -3.76 | 2,050 | 2,040 | 43,356 | 664 |

| CGSM | 2,450 | 0.41 | 0.82 | -6.84 | 2,450 | 2,420 | 19,329 | 4,800 |

| DBDE | 2,070 | 0.00 | 0.00 | -3.27 | 2,080 | 2,050 | 11,635 | 38 |

| JSL | 3,440 | -0.29 | -0.29 | -21.82 | 3,490 | 3,430 | 1,350 | 88 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 1Q24 | 1,298 | 16,580 | 4.93 | 0.39 | 1.45 | 9.69 |

| GTI | 2Q24 | 47 | 7,165 | 86.93 | 0.57 | 0.49 | 17.16 |

| PPAP | 2Q24 | 1,800 | 39,401 | 7.42 | 0.34 | 2.08 | 4.79 |

| PPSP | 2Q24 | 85 | 3,560 | 26.03 | 0.62 | 1.41 | 7.89 |

| PAS | 2Q24 | 1,132 | 11,977 | 10.14 | 0.96 | 2.54 | 6.50 |

| ABC | 2Q24 | 1,554 | 13,448 | 4.81 | 0.56 | 0.94 | NA |

| PEPC* | 4Q24 | -1,035 | 165 | NA | 14.68 | 4.29 | NA |

| MJQE | 2Q24 | 59 | 314 | 34.92 | 6.52 | 4.32 | 29.78 |

| CGSM | 2Q24 | 160 | 609 | 15.27 | 4.02 | 6.49 | 15.39 |

| JSL | 2Q24 | 1 | 669 | 4108.64 | 5.14 | 1.06 | NA |

| DBDE | 2Q24 | 80 | 1,932 | 25.85 | 1.07 | 0.55 | 8.80 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,323 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,527 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,152 |

| PPSP29A | 0 | 0.0 | - - | KhAAA | Guaranteed Green | Term SOFR + 1.5% | 1,714 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 181 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 2,922 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,169 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 2,996 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 684 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,541 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 5 Y | 10 Y | |

| Total issuance ('K units) | 180.1 | 312.0 | 85.3 | 10.0 | 0.0 |

| Outstanding (KHR'bn) | 52.0 | 312.0 | 85.3 | 10.0 | 0.0 |

| Issuance ('K units, Latest) | 10.0 | 20.0 | 20.0 | 10.0 | 0.0 |

| Coupon rate (Latest) | 3.50% | 4.00% | 4.50% | 5.00% | 5.25% |

| Successful yield (Latest) | 3.85% | 4.00% | 5.13% | 5.00% | - |

| Latest bidding | 24-Apr-24 | 29-May-24 | 18-Sep-24 | 45,497 | 45,525 |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board