SchneiTec Dynamic Co., Ltd

Infrastructure Bond Issuance

Lead Manager

USD 49.16mn

2025

Industry : Renewable Energy

Face Value (KHR) : 100,000

Issuing Price (KHR) : 100,000

Issuing Volume (units) : SNTD40A: 600,000; SNTD40B: 800,000; SNTD40C: 566,400

Issuing Date : March 28, 2025

Bond Feature : Green Infrastructure Bond

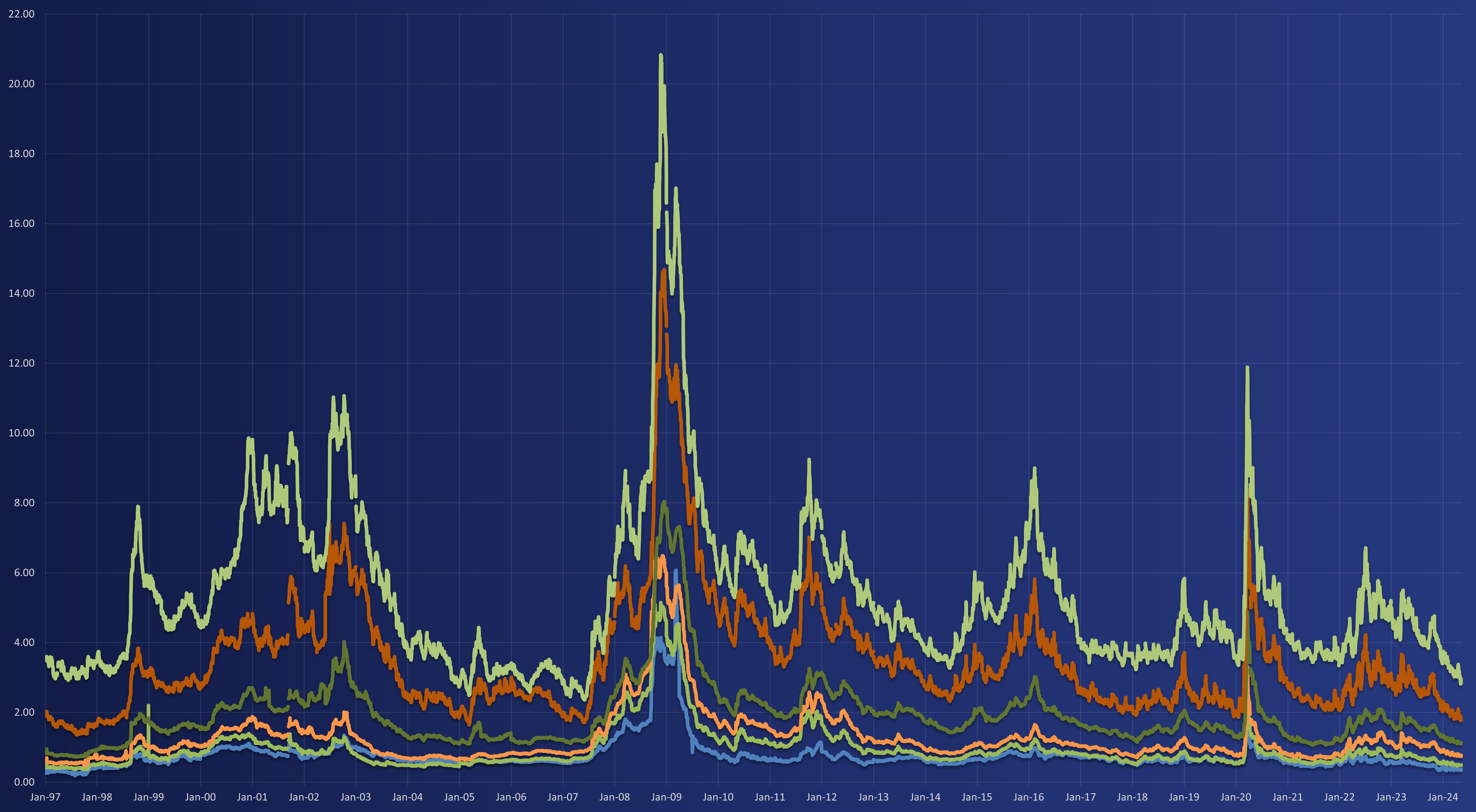

Coupon Rate (%) : SNTD40A: 180-Day SOFR Average + 1.80%; SNTD40B: 180-Day SOFR Average 1.60% [4,00%, 6.00%]; SNTD40C: 180-Day SOFR Average + 3.00%

Payment Frequency : Quarterly

Issue Term (year) : 15 years

Listing date : April 11, 2025

Website : www.schneitec.com.kh