Feasibility study for Phnom Penh-Siem Reap-Poipet Expressway completed

| News Highlights |

Economy and Industry

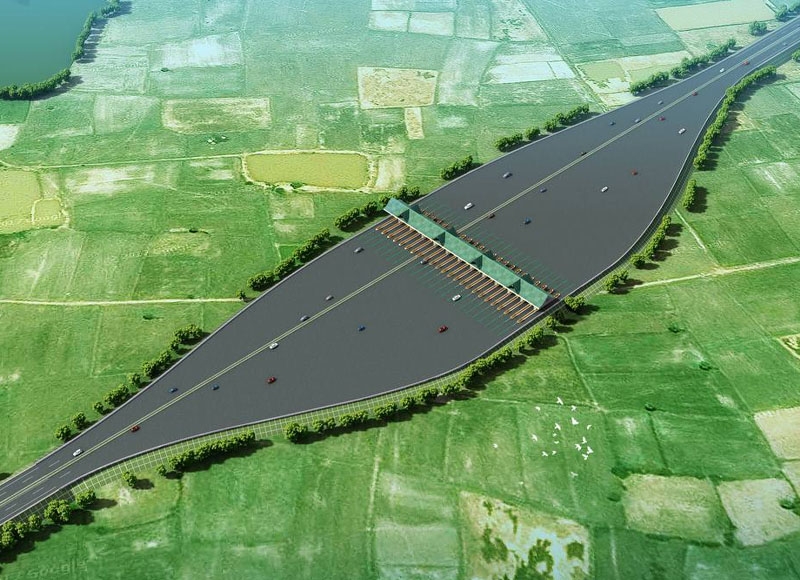

Feasibility study for Phnom Penh-Siem Reap-Poipet Expressway completed China Road and Bridge Corporation (CRBC) has completed a feasibility study for the proposed Phnom Penh-Siem Reap-Poipet Expressway, Cambodia's third expressway project. This project, which begins at Win-Win Boulevard and ends at Poipet City on the Thai border, is divided into two phases. The first phase spans over 249 kilometers and is estimated to cost $2.5 billion, while the second phase, from Siem Reap to Poipet, is projected to cost $1.7 billion. CRBC has conducted various surveys, including traffic volume, hydrological, geotechnical, topographical, and assessments of cultural relics and nature reserves. The report is now being prepared for submission to the Cambodian government for review. Aiming to enhance connectivity and stimulate economic growth in the region, this project is part of CRBC's broader involvement in Cambodia, which also includes the Phnom Penh-Sihanoukville Expressway. (Source: Khmer Times)

Construction sector faces fewer projects but sees significant increase in investment and material production Cambodia's construction sector saw a 23% YoY decline in the number of projects and a 9% YoY reduction in total area during the first five months of this year, according to the Ministry of Economy and Finance's "Socio-Economic Trend Report" for May. Despite the downturn, certain subsectors were notably active, with 1,095 housing developments, 88 industrial constructions, 90 commercial constructions, 21 tourism-related projects, 35 public constructions, and one construction investment project approved. Although new construction project approvals dropped by 20.2% YoY, there was a significant increase in the import and production of construction materials. Construction material imports surged by 23.1% YoY, and domestic cement production rose by 4.7% YoY. In May alone, 231 projects were approved, marking a 14.1% YoY decrease, but the total area of these projects reached 1.373 million square meters, a 49.7% YoY increase. The ongoing rise in construction material imports and production underscores the sector's resilience and adaptation to current economic conditions. (Source: Khmer Times)

Cambodia's dry rubber exports reach $213.3 million in the first half of 2024 Cambodia's dry rubber exports surged by 8.6% YoY to $213.3 million in the first half of 2024, as reported by the General Directorate of Rubber. During this period, the country exported 140,653 tonnes of dry rubber, marking a modest 1% increase from the 139,220 tonnes shipped during the same period last year. The average price per ton of dry rubber was $1,517, up by $107 compared to last year. Cambodia predominantly exports to Malaysia, Vietnam, Singapore, and China, consolidating its position as a key player in the regional rubber market. Currently, the country has cultivated rubber trees on 78.6% of its designated land. (Source: Khmer Times)

Corporate News

MinebeaMitsumi broadens operations in Pursat MinebeaMitsumi, a major Japanese industrial powerhouse, is expanding its business in Cambodia with a new factory in Pursat province. In a recent courtesy call to Sun Chanthol, Deputy Prime Minister and First Vice President of the Council for the Development of Cambodia (CDC), Chairman and CEO Yoshihisa Kainuma expressed gratitude for the CDC's support in coordinating the expansion and requested further assistance to ensure regulatory compliance. Minebea Cambodia, a subsidiary of MinebeaMitsumi, began operations in 2011 and has since expanded its production lines to include ball bearings, fan motors, micro actuators, brush DC motors, resonant devices, strain gauges, pressed parts, plastic injection moulded parts, LED backlights, wireless lighting controllers, and other industrial products. (Source: Khmer Times)

Stock Market

CSX index rises 0.25% on July 18, 2024, with mixed stock performance On July 18, 2024, the CSX Index closed at 415.9 points, a 0.25% increase from the previous day. On the main board, gains were observed in PPAP (+1.18%), GTI (+0.90%), MJQE (+0.49%), and CGSM (+0.41%), while PAS (-0.17%) declined. PWSA, PPSP, ABC, and PEPC remained unchanged. On the growth board, DBDE held steady, while JSL rose by 1.98%. The total trading volume for the day was 121,111 shares, with a cumulative trading value of KHR 538 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 415.87 | 0.25 | 121,111 | 11,154 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,040 | 0.00 | 0.86 | -3.30 | 7,080 | 6,940 | 137,481 | 612 |

| GTI | 3,350 | 0.90 | 16.72 | 17.96 | 3,350 | 2,380 | 560,826 | 134 |

| PPAP | 15,780 | 1.81 | 23.47 | 12.71 | 17,240 | 12,700 | 130,809 | 326 |

| PPSP | 2,280 | 0.00 | 3.17 | 4.59 | 2,300 | 2,140 | 339,399 | 164 |

| PAS | 12,080 | -0.17 | -0.66 | -3.97 | 12,320 | 11,880 | 80,931 | 1,036 |

| ABC | 7,520 | 0.00 | -1.05 | -25.25 | 7,600 | 7,380 | 345,718 | 3,257 |

| PEPC | 2,390 | 0.00 | 7.66 | -12.77 | 2,450 | 2,140 | 12,880 | 179 |

| MJQE | 2,050 | 0.49 | 0.49 | -3.76 | 2,050 | 2,030 | 120,703 | 664 |

| CGSM | 2,440 | 0.41 | -0.41 | -7.22 | 2,460 | 2,390 | 196,735 | 4,781 |

| DBDE | 2,090 | 0.00 | 0.48 | -2.34 | 2,270 | 2,060 | 75,653 | 39 |

| JSL | 3,600 | 1.98 | -1.37 | -18.18 | 3,790 | 3,360 | 8,778 | 93 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 1Q24 | 1,298 | 16,580 | 5.42 | 0.42 | 1.60 | 9.97 |

| GTI | 1Q24 | 106 | 7,068 | 31.50 | 0.47 | 0.40 | 12.80 |

| PPAP | 1Q24 | 1,952 | 38,178 | 8.08 | 0.41 | 2.33 | 5.54 |

| PPSP | 1Q24 | 445 | 3,501 | 5.12 | 0.65 | 1.19 | 5.58 |

| PAS | 1Q24 | 1,803 | 11,721 | 6.70 | 1.03 | 3.00 | 5.70 |

| ABC | 1Q24 | 1,518 | 13,222 | 4.95 | 0.57 | 0.97 | NA |

| PEPC* | 4Q23 | -477 | 842 | NA | 2.84 | 4.20 | 65.04 |

| MJQE | 4Q23 | 59 | 297 | 34.82 | 6.91 | 4.44 | 13.75 |

| CGSM | 4Q23 | 166 | 563 | 14.69 | 4.33 | 6.40 | 15.41 |

| JSL | 4Q23 | 274 | 593 | 13.13 | 6.07 | 1.34 | NA |

| DBDE | 1Q24 | 250 | 1,930 | 8.37 | 1.08 | 0.50 | 5.64 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,407 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,611 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,236 |

| PPSP29A | 0 | 0.0 | - - | KhAAA | Guaranteed Green | Term SOFR + 1.5% | 1,798 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 265 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,006 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,253 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,080 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 768 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,625 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 180.1 | 312.0 | 65.3 | - | - |

| Outstanding (KHR'bn) | 80.0 | 312.0 | 65.3 | - | - |

| Issuance ('K units, Latest) | 10.0 | 20.0 | 43.3 | - | - |

| Coupon rate (Latest) | 3.50% | 4.00% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 4.00% | 4.63% | - | - |

| Latest bidding | 24-Apr-24 | 29-May-24 | 26-Jun-24 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board