Bakong system sees 180% YoY increase in number of KHR transactions in first half of 2024

| News Highlights |

Economy and Industry

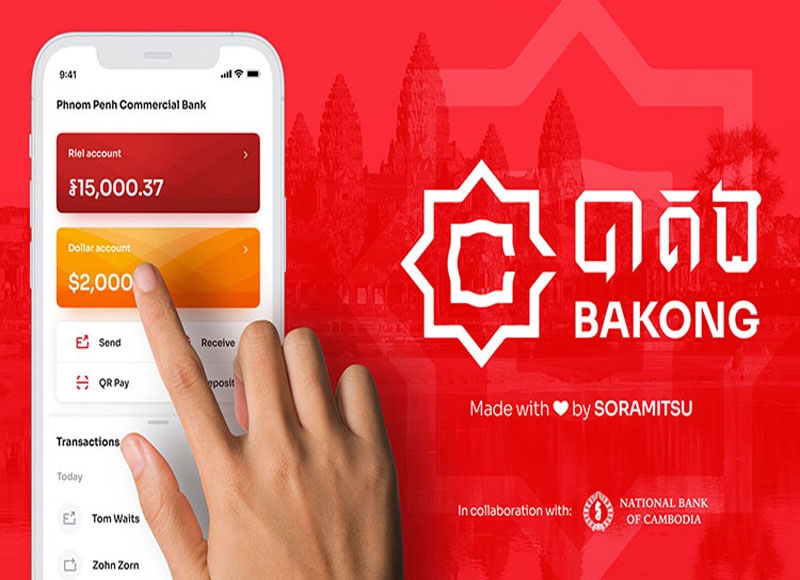

Bakong system sees 180% YoY increase in number of KHR transactions in first half of 2024 The National Bank of Cambodia (NBC) reported a significant surge in local currency payments through the Bakong system, with a 180% YoY increase in 'Riel currency' transactions during the first half of 2024, totaling 75.5 million transactions. This remarkable growth is attributed to the system's functionality and versatility, which have contributed to financial inclusion and enhanced Cambodia's international image. Compared to the same period last year, the number of transactions in KHR increased by 180%, reaching 75.5 million times. The overall transaction amount rose by 140% YoY, totaling 64.9 trillion riels. Additionally, the Bakong Tourists App, developed by NBC Governor Chea Serey, aims to boost the tourism industry by offering a modern digital payment experience for foreign travelers, allowing users to receive and transfer funds using a personalized QR code or mobile phone number, thereby redefining mobile payment and banking in Cambodia. (Source: Khmer Times)

CDC approves $396m in investment projects in July 2024 The Council for the Development of Cambodia (CDC) approved 44 investment projects in July 2024, totaling over $396 million in capital and creating approximately 25,000 jobs. Of these projects, 41 are new ventures and three are expansions of existing ones, with 31 located outside special economic zones (SEZs) and 13 within SEZs. Notably, the most significant project outside an SEZ is the expansion of a laundry, dyeing, and printing facility in Kraing Tea village, Preah Nipean commune. The highest-profile initiative is the establishment of the Koh Kong Zhejiang SEZ in Chroy Svay commune, with a $100 million investment, creating 331 jobs. Additionally, a Galatin food processing plant will be constructed within the new Koh Kong Zhejiang SEZ, with an investment of over $26 million, expected to create 194 jobs. Chinese investment accounted for 68.06% of the total capital financing in July, while domestic investment comprised 14.24%. The garment sector remains particularly attractive for financiers, with 10 projects, followed by the electricity sector with five and the plastics industry with four. (Source: Phnom Penh Post)

JETRO explores investment opportunities in Cambodia A delegation of Japanese companies, led by the Japan External Trade Organization (JETRO), has shown keen interest in investing in Cambodia, particularly in green industries. Representatives from 19 Japanese private companies commended the Cambodian government's efforts to enhance the investment climate. They are considering investments in various sectors, with a strong focus on green technology and carbon credits. The delegation highlighted the potential of introducing advanced Japanese technology to promote sustainable development in Cambodia. Prime Minister Hun Manet welcomed the JETRO delegation and reaffirmed the Cambodian government's commitment to facilitating foreign investment. This meeting marked a significant step in strengthening economic ties between Japan and Cambodia, with both parties agreeing to initiate discussions on a bilateral free trade agreement. Additionally, the Cambodian government is preparing a policy to establish Cambodia-Japan special economic zones to attract more Japanese investors. (Source: Khmer Times)

Corporate News

Thai oil and retail giant plans further expansion in Cambodia Thailand-based PTT Oil and Retail Business (OR) plans to significantly increase investments in its Cambodia oil and retail operations over the next four years, from 2024 to 2028. CEO Disathat Panyarachun announced that OR will invest 8 billion baht, approximately $225 million, to expand its overseas business interests during this period. The company's subsidiary, PTT (Cambodia) Ltd., operates oil and retail businesses in Cambodia, Laos, Vietnam, and the Philippines. OR also intends to invest in fuel depots and jet fuel provision to meet Cambodia's growing demand for airborne transport. Currently, OR and Total Energies (Cambodia) supply jet fuel to aircraft at Phnom Penh's international airport. In August, OR invested $100 million to build a new oil depot in Cambodia specifically for aviation refuelling at the Techo International Airport (TIA), which is nearing completion. (Source: Khmer Times)

Stock Market

CSX index rises 0.21% amid mixed stock performance on August 8, 2024 On August 8, 2024, the CSX Index closed at 413.2 points, marking a 0.21% decrease from the previous day. Notable gains were seen with PEPC (+1.23%), PPSP (+0.85%), and PPAP (+0.27%), while declines were observed in GTI (-1.60%), PAS (-0.66%), ABC (-0.53%), and PWSA (-0.29%). Stocks MJQE and CGSM remained unchanged. On the growth board, DBDE closed at its opening price, whereas JSL dropped by 0.29%. The total trading volume for the day was 69,817 shares, with a cumulative trading value of KHR 218 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 413.15 | -0.21 | 69,817 | 11,081 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 6,960 | -0.29 | -0.57 | -4.40 | 7,060 | 6,960 | 18,489 | 605 |

| GTI | 3,700 | -1.60 | -2.63 | 30.28 | 3,800 | 3,280 | 29,257 | 148 |

| PPAP | 14,980 | 0.27 | 2.60 | 7.00 | 16,200 | 14,560 | 7,076 | 310 |

| PPSP | 2,360 | 0.85 | 3.06 | 8.26 | 2,360 | 2,250 | 210,428 | 170 |

| PAS | 12,000 | -0.66 | -0.50 | -4.61 | 12,180 | 12,000 | 5,316 | 1,029 |

| ABC | 7,460 | -0.53 | -0.53 | -25.84 | 7,540 | 7,460 | 193,859 | 3,231 |

| PEPC | 2,470 | 1.23 | 0.00 | -9.85 | 2,520 | 2,390 | 3,756 | 185 |

| MJQE | 2,040 | 0.00 | -0.49 | -4.23 | 2,060 | 2,030 | 36,383 | 661 |

| CGSM | 2,420 | 0.00 | 0.00 | -7.98 | 2,440 | 2,400 | 59,521 | 4,741 |

| DBDE | 2,090 | 0.00 | 0.00 | -2.34 | 2,100 | 2,080 | 15,841 | 39 |

| JSL | 3,470 | -0.29 | -0.86 | -21.14 | 3,850 | 3,470 | 41,661 | 89 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 1Q24 | 1,298 | 16,580 | 5.36 | 0.42 | 1.58 | 9.94 |

| GTI | 1Q24 | 106 | 7,068 | 34.79 | 0.52 | 0.44 | 13.76 |

| PPAP | 1Q24 | 1,952 | 38,178 | 7.67 | 0.39 | 2.21 | 5.30 |

| PPSP | 1Q24 | 445 | 3,501 | 5.30 | 0.67 | 1.23 | 5.73 |

| PAS | 1Q24 | 1,803 | 11,721 | 6.66 | 1.02 | 2.98 | 5.68 |

| ABC | 1Q24 | 1,518 | 13,222 | 4.91 | 0.56 | 0.96 | NA |

| PEPC* | 4Q23 | -477 | 842 | NA | 2.93 | 4.34 | 65.83 |

| MJQE | 4Q23 | 59 | 297 | 34.65 | 6.88 | 4.42 | 13.68 |

| CGSM | 4Q23 | 166 | 563 | 14.57 | 4.30 | 6.34 | 15.30 |

| JSL | 4Q23 | 274 | 593 | 12.65 | 5.85 | 1.29 | NA |

| DBDE | 1Q24 | 250 | 1,930 | 8.37 | 1.08 | 0.50 | 5.64 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,386 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,590 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,215 |

| PPSP29A | 0 | 0.0 | - - | KhAAA | Guaranteed Green | Term SOFR + 1.5% | 1,777 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 244 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 2,985 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,232 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,059 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 747 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,604 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 5 Y | 10 Y | |

| Total issuance ('K units) | 180.1 | 312.0 | 65.3 | 10.0 | - |

| Outstanding (KHR'bn) | 52.0 | 312.0 | 65.3 | 10.0 | - |

| Issuance ('K units, Latest) | 10.0 | 20.0 | 43.3 | 10.0 | - |

| Coupon rate (Latest) | 3.50% | 4.00% | 4.50% | 5.00% | - |

| Successful yield (Latest) | 3.85% | 4.00% | 4.63% | 5.00% | - |

| Latest bidding | 24-Apr-24 | 29-May-24 | 26-Jun-24 | 45,497 | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board