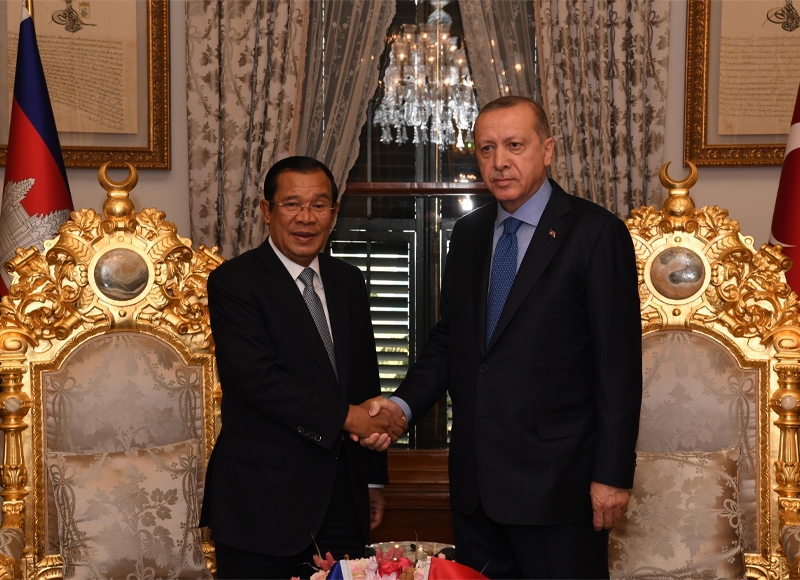

Cambodia and Turkey aim for $1 billion trade

| News Highlights |

Economy and Industry

Cambodia and Turkey aim for $1 billion trade Cambodia and Turkey have committed to boosting bilateral trade to $1 billion annually and advancing plans for direct flights between Phnom Penh and Istanbul. The agreement was solidified during a recent meeting in Ankara between Cambodian Deputy Prime Minister Sok Chenda Sophea and Turkish Trade Minister Omer Bolat. Currently celebrating 65 years of diplomatic relations, the two nations noted that their trade volume tripled over the last decade, reaching $238 million in 2023. Bolat emphasized the opportunities for Turkish companies in Cambodia's rapidly growing economy, especially in green energy, medical devices, textiles, and agriculture. The direct flights by Turkish Airlines are expected to enhance economic and tourism interactions. At a business luncheon in Ankara, Sophea encouraged Turkish investments in Cambodia's tourism, agriculture, logistics, and construction sectors, highlighting the Kingdom as a gateway to Southeast Asia under ASEAN Free Trade Area and the Regional Comprehensive Economic Partnership. Turkish Ambassador Ulku Kocaefe also expressed optimism about strengthening regional cooperation through enhanced flight connections and trade initiatives. (Source: Khmer Times)

CRF eyes expansion after successful Saudi Food Expo The Cambodia Rice Federation (CRF) is optimistic about expanding its rice market following a successful participation in the Saudi Food Expo in Riyadh, which attracted significant interest from buyers across the Middle East and Africa. The CRF delegation, including four leading rice millers and exporters, showcased Cambodia's premium rice varieties, impressing attendees with their quality and distinct flavors. CRF Secretary-General Lun Yeng highlighted that the expo provided a valuable opportunity to introduce Cambodian rice to new international markets, aligning with the government's initiative to diversify export destinations beyond traditional markets like Vietnam, China, and the EU. With growing demand in the Middle East and Africa, Cambodia's rice exports to these regions have significantly increased, from 1,398 tons to 7,521 tons and from 4,284 tons to 52,828 tons respectively from 2015 to 2023. In 2023, Cambodia exported 656,323 tons of milled rice, earning $466 million, a 13% increase YoY. (Source: Khmer Times)

Cambodia Securities Exchange (CSX) launches zero commission promotion In a groundbreaking move, the Cambodia Securities Exchange (CSX) has announced a "Zero Commissions on All Stock Purchases" promotion, effective from May 27 to June 28, 2024. This initiative allows investors to buy any stocks listed on the CSX without incurring any fees through any member brokerage firms. Timed with the dividend distribution season, this promotion aims to enhance market accessibility and boost trading volumes. The CSX anticipates increased liquidity and trading activity, providing investors with greater flexibility and potential growth in their portfolios. This initiative reflects CSX's commitment to transparency and investor satisfaction. Additionally, the CSX recently introduced USD settlement for trades made in Khmer riel (KHR) and launched an Online Trading Account Opening Platform to improve accessibility for local and overseas traders. The CSX, established in 2012, currently has 23 listed companies and operates under the oversight of the Securities and Exchange Regulator of Cambodia (SERC). (Source: Khmer Times)

Corporate News

Visa promotes digital and financial inclusion in SEA Visa is dedicated to promoting digital and financial inclusion by equipping women and youth in Southeast Asia with essential skills for sustainable growth, as per their May 29 press release. An OECD report highlights barriers faced by rural communities, women, and certain ethnic minorities in adopting digital solutions. With young people constituting nearly a third of the population and SMEs making up 99% of businesses, Visa's initiatives are crucial for economic growth. In 2023, Visa digitally enabled 10 million SMEs in Asia Pacific and committed over $47M, aiding two million women-led SMEs and sustaining 500,000 jobs. Visa's partnerships with organizations like WISE Vietnam and The Asia Foundation support local businesses and promote financial literacy. In Cambodia, Visa's collaboration with MoWA and NBC has benefited over 10,000 women entrepreneurs, aligning with national goals to reduce financial exclusion. Through strategic partnerships, Visa is advancing digitization and fostering equitable futures in Southeast Asia. (Source: Khmer Times)

Stock Market

CSX index closes at 415.0 points with mixed results on main board On May 31, 2024, the CSX index closed at 415.0 points, down 0.19% from the previous day. The main board showed mixed results: PAS (+0.32%) and PWSA (+0.27%) posted gains, while PPSP (-2.08%), PEPC (-1.28%), GTI (-1.26%), and CGSM (-0.41%) declined. PPAP, ABC, and MJQE remained unchanged. On the growth board, DBDE rose by 1.36% and JSL decreased by 1.86%. The total trading volume was 160,550 shares, with a cumulative trading value of KHR 701 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 415.01 | -0.19 | 160,550 | 11,131 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,340 | 0.27 | 4.86 | 0.82 | 7,380 | 7,000 | 143,648 | 638 |

| GTI | 2,350 | -1.26 | 4.44 | -17.25 | 2,380 | 2,260 | 77,002 | 94 |

| PPAP | 13,400 | 0.00 | 3.40 | -4.29 | 13,460 | 13,000 | 13,058 | 277 |

| PPSP | 2,350 | -2.08 | 14.63 | 7.80 | 2,400 | 2,030 | 1,007,588 | 169 |

| PAS | 12,540 | 0.32 | 0.97 | -0.32 | 12,540 | 12,300 | 4,604 | 1,076 |

| ABC | 7,620 | 0.00 | 0.26 | -24.25 | 7,800 | 7,420 | 1,782,147 | 3,301 |

| PEPC | 2,320 | -1.28 | 8.92 | -15.33 | 2,400 | 2,150 | 11,498 | 174 |

| MJQE | 2,040 | 0.00 | -7.27 | -4.23 | 2,230 | 2,040 | 1,114,057 | 661 |

| CGSM | 2,420 | -0.41 | 1.68 | -7.98 | 2,440 | 2,380 | 301,315 | 4,741 |

| DBDE | 2,230 | 1.36 | 6.70 | 4.21 | 2,230 | 2,100 | 183,406 | 41 |

| JSL | 4,220 | -1.86 | 12.53 | -4.09 | 4,320 | 3,880 | 18,513 | 108 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 4Q23 | 1,456 | 16,034 | 5.04 | 0.46 | 1.65 | 8.47 |

| GTI | 4Q23 | 109 | 7,145 | 21.57 | 0.33 | 0.28 | 10.01 |

| PPAP* | 4Q23 | 1,534 | 38,520 | 8.73 | 0.35 | 1.95 | 4.82 |

| PPSP | 4Q23 | 451 | 3,530 | 5.21 | 0.67 | 0.66 | 3.93 |

| PAS* | 4Q23 | 1,422 | 11,333 | 8.82 | 1.11 | 2.95 | 7.66 |

| ABC | 4Q23 | 1,207 | 13,033 | 6.31 | 0.58 | 0.97 | NA |

| PEPC** | 4Q23 | -477 | 842 | NA | 2.76 | 4.07 | 64.35 |

| MJQE | 4Q23 | 59 | 297 | 34.65 | 6.88 | 4.42 | 13.68 |

| CGSM | 4Q23 | 166 | 563 | 14.57 | 4.30 | 6.34 | 15.30 |

| JSL | 4Q23 | 274 | 593 | 15.39 | 7.12 | 1.57 | NA |

| DBDE | 4Q23 | 221 | 1,883 | 10.10 | 1.18 | 0.48 | 6.65 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,455 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,659 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,284 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 313 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,054 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,301 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,128 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 816 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,673 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 180.1 | 292.0 | 22.0 | - | - |

| Outstanding (KHR'bn) | 80.0 | 292.0 | 22.0 | - | - |

| Issuance ('K units, Latest) | 10.0 | 140.0 | 6.0 | - | - |

| Coupon rate (Latest) | 3.50% | 4.50% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 5.13% | 4.75% | - | - |

| Latest bidding | 24-Apr-24 | 20-Mar-24 | 20-Dec-23 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board