PM Hun Manet highlights Cambodia-Korea trade and investment relations

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 417.33 | 0.45 | 355,059 | 11,193 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,260 | 0.00 | 3.71 | -0.27 | 7,260 | 7,000 | 72,508 | 631 |

| GTI | 2,290 | 0.88 | 1.78 | -19.37 | 2,350 | 2,180 | 51,830 | 92 |

| PPAP | 13,400 | 0.30 | 3.40 | -4.29 | 13,400 | 12,380 | 7,305 | 277 |

| PPSP | 2,230 | 9.85 | 8.78 | 2.29 | 2,230 | 2,030 | 279,152 | 160 |

| PAS | 12,460 | 0.16 | 0.32 | -0.95 | 12,480 | 12,140 | 2,219 | 1,069 |

| ABC | 7,780 | -0.26 | 2.37 | -22.66 | 8,520 | 7,420 | 1,299,984 | 3,370 |

| PEPC | 2,250 | 2.74 | 5.63 | -17.88 | 2,510 | 2,130 | 4,306 | 169 |

| MJQE | 2,050 | -0.49 | -6.82 | -3.76 | 2,230 | 2,050 | 839,902 | 664 |

| CGSM | 2,430 | 0.83 | 2.10 | -7.60 | 2,480 | 2,370 | 166,331 | 4,761 |

| DBDE | 2,200 | 0.92 | 5.26 | 2.80 | 2,200 | 2,080 | 102,895 | 41 |

| JSL | 3,970 | -0.50 | 5.87 | -9.77 | 3,990 | 3,670 | 12,995 | 102 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 4Q23 | 1,456 | 16,034 | 4.99 | 0.45 | 1.63 | 8.43 |

| GTI | 4Q23 | 109 | 7,145 | 21.02 | 0.32 | 0.28 | 9.85 |

| PPAP* | 4Q23 | 1,534 | 38,520 | 8.73 | 0.35 | 1.95 | 4.82 |

| PPSP | 4Q23 | 451 | 3,530 | 4.94 | 0.63 | 0.63 | 3.77 |

| PAS* | 4Q23 | 1,422 | 11,333 | 8.76 | 1.10 | 2.93 | 7.62 |

| ABC | 4Q23 | 1,207 | 13,033 | 6.44 | 0.60 | 0.99 | NA |

| PEPC** | 4Q23 | -477 | 842 | NA | 2.67 | 3.95 | 63.67 |

| MJQE | 4Q23 | 59 | 297 | 34.82 | 6.91 | 4.44 | 13.75 |

| CGSM | 4Q23 | 166 | 563 | 14.63 | 4.31 | 6.37 | 15.35 |

| JSL | 4Q23 | 274 | 593 | 14.47 | 6.69 | 1.48 | NA |

| DBDE | 4Q23 | 221 | 1,883 | 9.96 | 1.17 | 0.48 | 6.58 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,469 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,673 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,298 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 327 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,068 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,315 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,142 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 830 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,687 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 180.1 | 292.0 | 22.0 | - | - |

| Outstanding (KHR'bn) | 80.0 | 292.0 | 22.0 | - | - |

| Issuance ('K units, Latest) | 10.0 | 140.0 | 6.0 | - | - |

| Coupon rate (Latest) | 3.50% | 4.50% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 5.13% | 4.75% | - | - |

| Latest bidding | 24-Apr-24 | 20-Mar-24 | 20-Dec-23 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| News Highlights |

Stock Market

CSX index regains positive momentum with PPSP surge On May 17, 2024, the CSX index closed at 417.3 points, up 0.45% from the previous day. The main board showed mixed results: PPSP (+9.85%), PEPC (+2.74%), GTI (+0.88%), CGSM (+0.83%), PPAP (+0.30%), and PAS (+0.16%) posted gains, while MJQE (-0.49%) and ABC (-0.26%) saw declines. PWSA remained unchanged. On the growth board, DBDE rose by 0.92%, whereas JSL fell by 0.50%. The total trading volume was 355,059 shares, with a cumulative trading value of KHR 1,169 million. (Source: YSC Research)

Economy and Industry

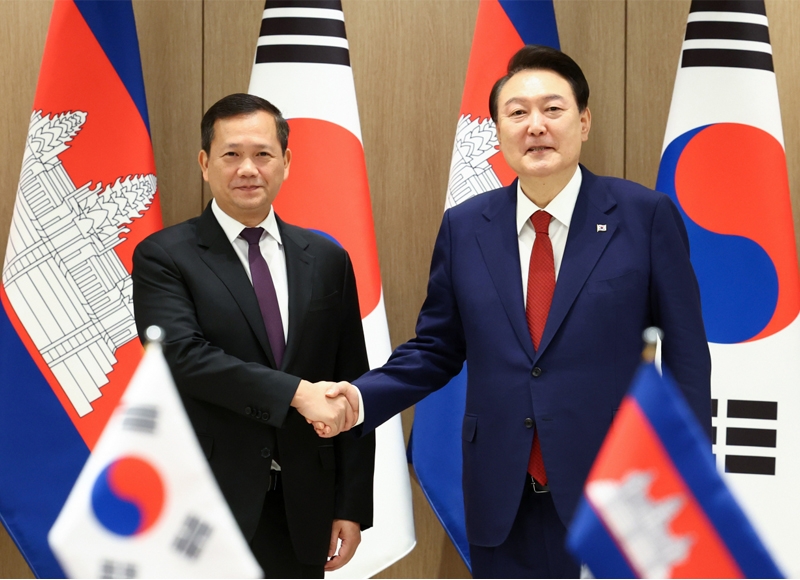

PM Hun Manet highlights Cambodia-Korea trade and investment relations Prime Minister Hun Manet announced that bilateral trade between the Republic of Korea and Cambodia reached approximately $751 million last year, with Korea's foreign direct investment (FDI) in Cambodia totaling $30 million, bringing cumulative FDI from Korea to $5 billion. This statement was made during the Cambodia-Korea Business Forum (CKBF) in Seoul, attended by over 300 investors from 198 companies. From the Cambodian side, Deputy PM Sun Chanthol and Sok Chenda, NBC Governor Chea Serey, and CCC President Kith Meng were amongst the officials representing the country. The CKFTA, signed in December 2022, was highlighted as a key facilitator for Korean investment and trade in Cambodia. The forum concluded with the signing of 4 MoUs, involving institutions like JB Financial Group, KB Kookmin Bank, Woori Bank, and the Korea Credit Bureau. These MoUs aim to enhance cross-border payments, remittances for migrant workers, and credit report sharing. (Source: Khmer Times)

Cambodia's GFT exports rise by 17% in 1Q24 Cambodia exported garment, footwear, and travel products (GFT) worth $3.76 billion in 1Q24, marking a 17% increase from $3.2 billion compared to the year prior, according to a Ministry of Commerce report. Apparel and textiles led the sector with $2.75 billion, a 20.4% YoY increase. Footwear exports reached $453.7 million, up 3.8%, while travel goods hit $562 million, up 14%. Poullang Doung, ADB's Cambodia Senior Economic Officer, highlighted the GFT sector's pivotal role in projecting a 5.8% economic growth for Cambodia in 2024, noting the sector's continued momentum since late 2023. As Cambodia's largest export earner, the GFT industry comprises about 1,680 factories and branches, employing approximately 918,000 workers, mostly women. (Source: Khmer Times)

Chinese delegation tours Cambodia's aquaculture practices Representatives from the Ministry of Agriculture, Forestry, and Fisheries (MAFF) hosted Chinese agricultural specialists from Shanghai Ocean University to promote integrated rice-fish and rice-shrimp farming systems in Cambodia. Led by Thay Somony, director at MAFF, the delegation toured provinces to support the 'Fish and Rice Corridor' initiative aimed at boosting bilateral agricultural trade. The team provided training to over 30 farmers on rice-shrimp farms in Takeo province and assessed prior projects. Professor Wu Xugan highlighted the need for infrastructure improvements, such as better water reservoirs to enhance yields. Currently, Cambodia aquaculture remains small-scale with limited skills, resulting in low productivity and high costs. (Source: Khmer Times)

Corporate News

Korean Entertainment Company seeks investment and business opportunities in Cambodia SM Entertainment, a prominent Korean entertainment company, has expressed interest in investing in and expanding its operations in Cambodia. The company, which focuses on organizing events and concerts, is currently cooperating with several ASEAN countries, including Cambodia. Prime Minister Hun Manet welcomed the company's intention to invest in Cambodia's entertainment industry, citing the popularity of Korean movies and K-pop music among young people. He also emphasized the importance of cultural exchange and tourism between the two countries. The premier encouraged SM Entertainment to collaborate with the Cambodian Embassy in Korea and the Ministry of Culture, Fine Arts, and Tourism of Cambodia to explore investment opportunities. Established in 1995, SM Entertainment is known for bringing K-pop to the global stage and donated $10,000 to the Cambodian Children's Fund in 2010. (Source: Khmer Times)

| Stock Charts |

Main Board

Growth Board