PM announces intentions to create high-tech, environmentally friendly SEZs

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 466.72 | -0.20 | 26,839 | 12,518 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,280 | 0.00 | 0.00 | 0.00 | 7,280 | 7,220 | 126 | 633 |

| GTI | 2,800 | 0.36 | 0.36 | -1.41 | 2,820 | 2,790 | 601 | 112 |

| PPAP | 13,980 | -0.14 | -0.14 | -0.14 | 14,000 | 13,800 | 245 | 289 |

| PPSP | 2,160 | -0.46 | -0.46 | -0.92 | 2,180 | 2,150 | 407 | 155 |

| PAS | 12,500 | -0.64 | -0.64 | -0.64 | 12,620 | 12,420 | 666 | 1,072 |

| ABC | 10,000 | 0.00 | 0.00 | -0.60 | 10,020 | 9,980 | 12,823 | 4,332 |

| PEPC | 2,830 | 1.07 | 1.07 | 3.28 | 2,900 | 2,560 | 32 | 212 |

| MJQE | 2,090 | 0.00 | 0.00 | -1.88 | 2,110 | 2,090 | 4,885 | 677 |

| CGSM | 2,570 | -0.39 | -0.39 | -2.28 | 2,640 | 2,560 | 7,617 | 5,035 |

| DBDE | 2,130 | 0.00 | 0.00 | -0.47 | 2,140 | 2,100 | 492 | 39 |

| JSL | 4,000 | -0.50 | -0.50 | -9.09 | 4,300 | 3,930 | 649 | 103 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 2Q23 | 1,170 | 15,172 | 6.22 | 0.48 | 1.73 | 8.84 |

| GTI | 2Q23 | 95 | 7,181 | 29.33 | 0.39 | 0.31 | 11.52 |

| PPAP* | 2Q23 | 2,412 | 38,041 | 5.80 | 0.37 | 2.06 | 4.98 |

| PPSP | 2Q23 | 489 | 3,576 | 4.42 | 0.60 | 0.68 | 3.85 |

| PAS* | 2Q23 | 1,191 | 11,029 | 10.49 | 1.13 | 3.23 | 8.19 |

| ABC | 2Q23 | 1,608 | 12,485 | 6.22 | 0.80 | 1.33 | NA |

| PEPC** | 2Q23 | -312 | 1,220 | NA | 2.32 | 2.67 | 33.98 |

| MJQE | 2Q23 | 29 | 289 | 72.54 | 7.22 | 5.51 | 17.36 |

| CGSM | 2Q23 | 98 | 392 | 26.34 | 6.55 | 6.46 | 15.42 |

| JSL | 2Q23 | -239 | 185 | NA | 21.57 | NA | NA |

| DBDE | 2Q23 | 76 | 1,919 | 28.15 | 1.11 | 0.52 | 11.61 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,575 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,779 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,404 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 433 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,174 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,421 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,248 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 936 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,793 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 170.1 | 132.0 | 22.0 | - | - |

| Outstanding (KHR'bn) | 74.0 | 132.0 | 22.0 | - | - |

| Issuance ('K units, Latest) | 22.0 | 28.0 | 6.0 | - | - |

| Coupon rate (Latest) | 3.50% | 4.00% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 4.45% | 4.75% | - | - |

| Latest bidding | 24-Jan-24 | 22-Nov-23 | 20-Dec-23 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| News Highlights |

Stock Market

CSX index drops 0.20% on February 1, 2024 On February 1, 2024, the CSX index closed at 466.7 points, marking a 0.20% decrease from the previous day. Noteworthy movements were observed on the main board, with increases in PEPC (+1.07%) and GTI (+0.36%). Conversely, PAS (-0.64%), PPSP (-0.46%), CGSM (-0.39%), and PPAP (-0.14%) experienced declines. PWSA, ABC, and MJQE maintained their opening prices. On the growth board, DBDE remained steady, while JSL saw a decrease of 0.50%. The day's trading activity involved 26,839 shares, with a cumulative trading value reaching KHR 168 million. (Source: YSC Research)

Economy and Industry

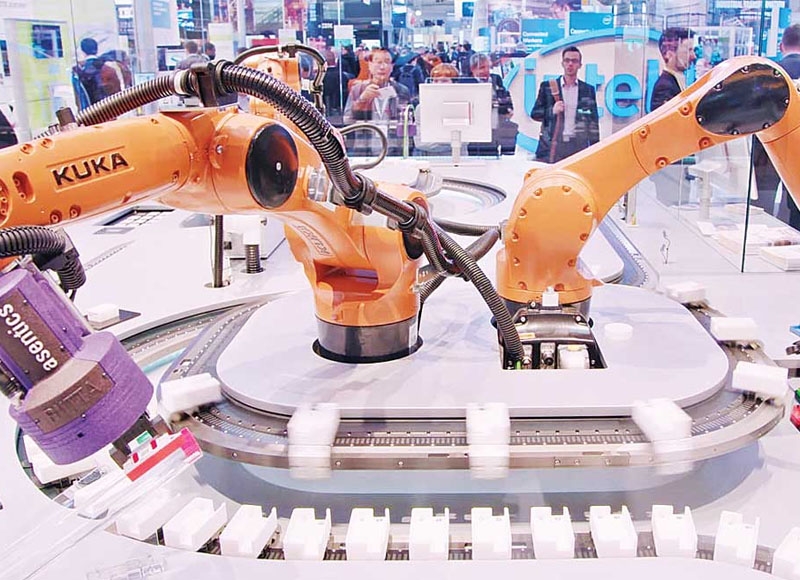

PM announces intentions to create high-tech, environmentally friendly SEZs Cambodia's Prime Minister Hun Manet has announced ambitious plans to establish a new type of special economic zone (SEZ) specifically designed for green industries and high-end technology investments. This model aims to differentiate itself from existing industrial parks by focusing on green technology, green industry, and the digital sector. The goal is to tailor SEZs to cater to specific industrial sectors. Additionally, the Cambodian government is exploring the creation of a special economic zone exclusively for investors from the same country, introducing a unique model distinct from existing SEZs with diverse international investors. This innovative approach is intended to complement existing SEZs rather than replace or compete with them. The Cambodian Chamber of Commerce vice-president, Lim Heng, has expressed support for this initiative, anticipating that the new model will generate more employment opportunities, boost exports, and contribute significantly to economic development. Cambodia has already attracted substantial fixed-assets investments, totaling $4.6 billion during the January-November period, with key foreign investors including China, Malaysia, the British Virgin Islands, Singapore, and Vietnam. (Source: Khmer Times)

Chinese companies own 90% of the garment factory According to the report "Cambodia Garment Manufacturing Market Report 2023-2032: Youthful Demographic Dividend Fuels Consumer Market Growth", Cambodia's garment manufacturing sector has seen significant growth since the 1990s, with around 90% owned by Chinese firms or investors. The sector is highly attractive to foreign direct investments, particularly from China, with Chinese-owned factories representing the majority. Cambodia's garment exports are primarily directed towards Western countries, with the EU being the largest market. The country's cost advantage and labor expertise continue to fuel the flow of investments, mainly from China and other European countries. The report also highlights the International Finance Corporation's Cambodia Improvement Programme (CIP), initiated in 2019 with support from the Ministry of Economy and Finance of Korea, which aims to enhance competitiveness, productivity, and sustainable growth of the garment sector. (Source: Khmer Times)

Taskforce seeks to restore Preah Sihanouk The Cambodian government has established a working group to stimulate investment in Preah Sihanouk province, which has faced sluggish development amid the Covid-19 pandemic. Chaired by Hean Sahip, the group will spearhead the government's "special programme to boost investment in Preah Sihanouk province in 2024." Functioning as a One Window Service Office, the group will streamline services for investors, oversee the approval of investment projects, and extend hospitality to potential investors. To ensure transparency and progress, the group will provide comprehensive evaluations of the special programme's implementation every three months. Preah Sihanouk province, once a significant Chinese investment hub, currently has approximately 1,150 unfinished buildings, with work resumed on around 100 of them. (Source: The Phnom Penh Post)

Corporate News

Panda Bank introduces the "Treasure Vault" that provides daily interest credits Panda Bank has introduced its 'Treasure Vault', a flexible term deposit that provides daily interest credit. With a minimum deposit amount of USD100 and a minimum placement period of 24 hours, the account can be instantly opened via Panda Bank's Mobile Banking App, transferred through Bakong, and placed in the Treasure Vault. Distinguishing itself in South East Asia, the Treasure Vault offers a daily interest rate of 0.02% or an annual rate exceeding 7.3%. The account features compounded interest post-crediting, ensuring exponential growth of savers' wealth over time. Catering to evolving financial needs, it provides flexibility and the freedom to withdraw funds at any time, making it an optimal choice for savers in the region. (Source: Khmer Times)

| Stock Charts |

Main Board

Growth Board