Guangxi and Cambodia: the hubs of ASEAN trade and cooperation

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 461.42 | 0.00 | 81,889 | 12,376 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,400 | -0.27 | -0.54 | -2.12 | 7,480 | 7,300 | 33,937 | 644 |

| GTI | 3,010 | -1.95 | -1.31 | -20.79 | 3,090 | 3,010 | 52,578 | 120 |

| PPAP | 14,020 | 0.00 | -0.71 | 0.14 | 14,180 | 13,960 | 2,499 | 290 |

| PPSP | 2,180 | -0.46 | -1.36 | -8.79 | 2,250 | 2,180 | 24,728 | 157 |

| PAS | 12,240 | -0.49 | -1.29 | -8.11 | 12,540 | 12,200 | 14,069 | 1,050 |

| ABC | 10,020 | 0.00 | 0.00 | -7.39 | 10,040 | 10,020 | 451,000 | 4,340 |

| PEPC | 2,490 | -0.40 | -3.11 | -20.95 | 2,730 | 2,300 | 6,373 | 187 |

| MJQE | 2,130 | 0.00 | -1.39 | NA | 2,180 | 2,100 | 114,107 | 690 |

| CGSM | 2,500 | 0.00 | -5.30 | NA | 2,780 | 2,400 | 341,811 | 4,898 |

| DBDE | 2,150 | -0.92 | -0.92 | -10.04 | 2,200 | 2,150 | 13,993 | 40 |

| JSL | 2,820 | 0.00 | -11.60 | -43.15 | 3,430 | 2,820 | 14,314 | 73 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 2Q23 | 1,170 | 15,172 | 6.33 | 0.49 | 1.76 | 8.90 |

| GTI | 2Q23 | 95 | 7,181 | 31.53 | 0.42 | 0.33 | 12.12 |

| PPAP* | 2Q23 | 2,412 | 38,041 | 5.81 | 0.37 | 2.07 | 5.00 |

| PPSP | 2Q23 | 489 | 3,576 | 4.46 | 0.61 | 0.68 | 3.88 |

| PAS* | 2Q23 | 1,191 | 11,029 | 10.28 | 1.11 | 3.16 | 8.06 |

| ABC | 2Q23 | 1,608 | 12,485 | 6.23 | 0.80 | 1.34 | NA |

| PEPC** | 2Q23 | -312 | 1,220 | NA | 2.04 | 2.35 | 32.41 |

| MJQE | 2Q23 | 29 | 289 | 73.93 | 7.36 | 5.62 | 17.68 |

| CGSM | 2Q23 | 98 | 392 | 25.62 | 6.37 | 6.28 | 15.05 |

| JSL | 2Q23 | -239 | 185 | NA | 15.21 | NA | NA |

| DBDE | 2Q23 | 76 | 1,919 | 28.41 | 1.12 | 0.53 | 11.70 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,540 |

| PPCB23B | 0 | 0.0 | - - | N/A | Plain | 6.50% | 4 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 569 |

| RRC32A | 0 | 0.0 | - - | N/A | Guaranteed | 7.00% | 3,310 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating* | 1,557 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 3,384 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 1,072 |

| *SOFR+3,5% or 5% (take which one is higher); **SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher) | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 128.1 | 104.0 | 8.0 | - | - |

| Outstanding (KHR'bn) | 86.3 | 104.0 | 8.0 | - | - |

| Issuance ('K units, Latest) | 28.0 | 28.0 | 4.0 | - | - |

| Coupon rate (Latest) | 3.48% | 4.00% | 4.50% | - | - |

| Successful yield (Latest) | 3.70% | 4.28% | 5.00% | - | - |

| Latest bidding | 45,126 | 45,154 | 45,091 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| News Highlights |

Stock Market

PWSA, GTI, PPSP, PAS, and PEPC lead declines The CSX index dropped 0.09% to 461.4 points on September 18, 2023. PWSA, GTI, PPSP, PAS, and PEPC all experienced declines of 0.27%, 1.95%, 0.46%, 0.49%, and 0.40%, respectively. For PPAP, ABC, MJQE, and CGSM, there are no movements. JSL is unchanged on the growth board, while DBDE is down 0.92%. The volume of trading increased by 58.6% from the previous day's closing volume to 81,889 shares, or KHR 693 million. (Source: YSC Research)

Economy and Industry

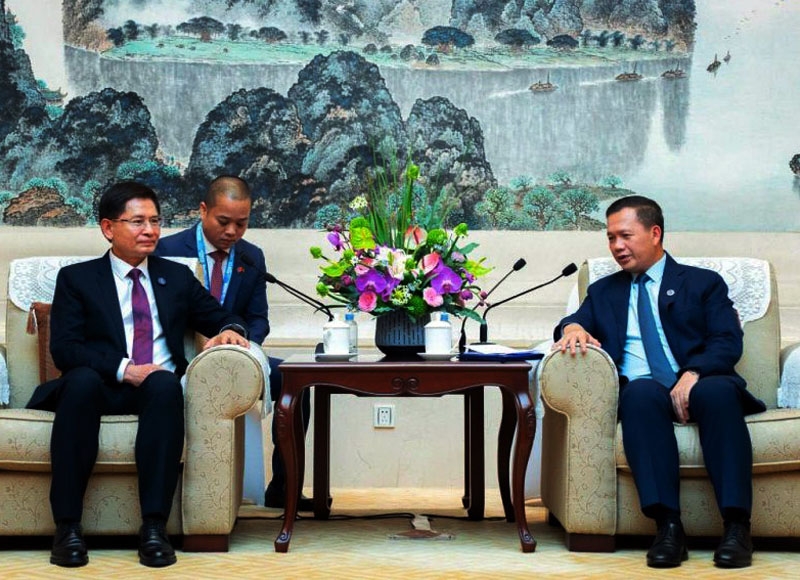

Guangxi and Cambodia: the hubs of ASEAN trade and cooperation Guangxi province and Cambodia's strategic locations have become gateways for ASEAN trade and cooperation. ASEAN markets accounted for 47.6% of Guangxi's foreign trade value in 2021, highlighting the importance of close economic ties between the two regions. Bilateral trade volume between Cambodia and China surged to nearly $11.2 billion in 2021, with China becoming Cambodia's largest export market. Bilateral trade volume between Cambodia and Guangxi increased by 88% in 2022, while exports from Cambodia to Guangxi increased by 85.3%. Cambodia's trade with China reached $7.09 billion in the first seven months of 2023, and trade between Cambodia and mainland China is expected to reach over $12 billion by the end of this year. China is the largest trading partner of Cambodia, followed by the US, Vietnam, Thailand, and Japan. China's foreign trade with ASEAN countries grew by 1.6% year-on-year to 4.11 trillion yuan ($566.89 billion) in the first eight months of 2023. (Source: Khmer Times)

Kingdom-Philippines trade is expected to reach $100 million this year The trade between Cambodia and the Philippines is expected to surpass $100 million this year, as economic ties between the two ASEAN Member States grow stronger. Ambassador Maria Amelita C. Aquino, the Philippines to Cambodia, announced that bilateral trade reached $100.10 in 2022, indicating a good pace of growth. The Philippines is a leading economy in the Asean bloc, with a projected growth of 6.2% in 2023 and 6.2% in 2024. Aquino encouraged participants to take an interest in doing business in the Philippines, particularly in the food and beverage and pharmaceutical sectors. She expressed confidence that the new law of the Philippines that liberalized rice imports could boost bilateral trade through imports of more rice from Cambodia. Additionally, efforts are being made to improve air connectivity between the Philippines and Cambodia, with efforts to resume Cebu-Siem Reap flights. (Source: Khmer Times)

Public debt increased by 24% in the first half of 2023 Cambodia has taken out $307.6 million concessional loans with development partners in Q2 2023, bringing its total public debt to $10.72 billion as of June 30, 2023. This represents an increase of over 4% from Q1 2023, with 99.6% of that from foreign creditors. The loans are highly concessional, with an average grant element of 45%, and are aimed at financing public investment projects in priority sectors that support long-term sustainable economic growth and increase economic productivity and production. The debt stock is made up of USD, SDR, Chinese yuan, Japanese yen, euro, and local and other currencies. In the first half of 2023, new concessional loans with development partners stood at $787.5 million, equivalent to SDR 586.9 million, and accounted for 35% of the ceiling permitted by the law or SDR 1.7 billion. The government has settled over $247.4 million of debt in the first half, including $66.7 million in the second quarter. (Source: The Phnom Penh Post)

Corporate News

8-month revenue decline for Phnom Penh Port Phnom Penh Autonomous Port (PPAP) revenue for August fell by 7% to $3.4 million, with port operations being its largest revenue generator. Income from port operations was at $3 million, compared to $3.2 million a year ago. However, fees from port authority activities and other services rose by four percent and 24% to $428,084 and $15,683, respectively. For the eight-month period ending August 31, 2023, revenue retreated 9% YoY to $23.4 million, with port operation income reducing 12% to $19.8 million. Container throughput fell by 4.3% YoY to 42,902 TEUs, while cargoes and gas fuel tonnage grew by 7.9% to 357,673 tonnes. Cargo vessels called on the port expanded by 10.1% to 218 vessels, while passenger boats and passenger numbers increased by eight times to 34 and 344.4% to 1,249 persons, respectively, last year. (Source: Kiripost)

| Stock Charts |

Main Board

Growth Board