CSX index posts weekly gain of 0.15%

| CSX Stocks |

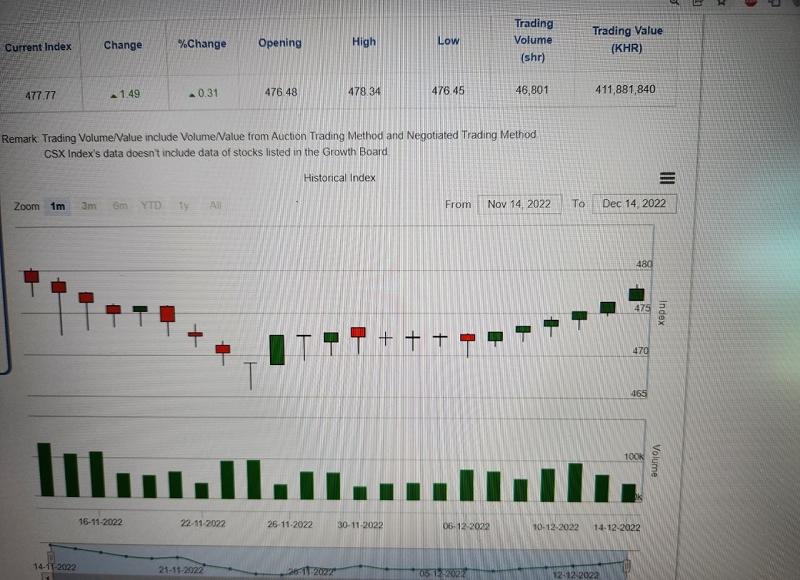

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 493.36 | 0.12 | 54,061 | 7,483 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,940 | 0.00 | 1.28 | 5.03 | 7,940 | 7,700 | 25,223 | 691 |

| GTI | 3,710 | 0.27 | 0.00 | -2.37 | 3,730 | 3,660 | 7,979 | 148 |

| PPAP | 14,900 | -0.67 | 0.00 | 6.43 | 15,140 | 14,320 | 3,924 | 308 |

| PPSP | 2,430 | 0.00 | 0.41 | 1.67 | 2,430 | 2,400 | 50,754 | 175 |

| PAS | 14,020 | 0.14 | -0.28 | 5.26 | 14,100 | 13,720 | 18,151 | 1,203 |

| ABC | 10,900 | 0.18 | 0.37 | 0.74 | 10,900 | 10,840 | 275,631 | 4,721 |

| PEPC | 3,160 | 0.00 | -0.63 | 0.32 | 3,200 | 3,150 | 9,859 | 237 |

| DBDE | 2,440 | 0.00 | 0.00 | 2.09 | 2,440 | 2,400 | 11,286 | 45 |

| JSL | 4,800 | -0.41 | 0.00 | -3.23 | 4,840 | 4,800 | 8,982 | 123 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 3Q22 | 1,242 | 9,852 | 6.39 | 0.81 | 1.99 | 8.51 |

| GTI | 3Q22 | 178 | 7,138 | 20.87 | 0.52 | 0.32 | 71.67 |

| PPAP | 3Q22 | 2,897 | 18,416 | 5.14 | 0.81 | 2.08 | 5.63 |

| PPSP | 3Q22 | 328 | 3,576 | 7.40 | 0.68 | 1.01 | 16.85 |

| PAS | 3Q22 | 1,568 | 5,986 | 8.94 | 2.34 | 3.39 | 15.02 |

| ABC | 3Q22 | 1,702 | 12,067 | 6.40 | 0.90 | 1.62 | NA |

| PEPC** | 2Q22 | 33 | 1,468 | 95.88 | 2.15 | 1.09 | 26.03 |

| DBDE | 3Q22 | -123 | 1,426 | NA | 1.71 | 0.73 | 2.64 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| News Highlights |

Stock Market

CSX index posts weekly gain of 0.15% On Feb 10, 2023, the CSX index closed at a seven-month high of 493.36pts, posting a weekly gain of 0.15%. ABC shares rose for the first time this week, up 0.18% to finish at a seven-month high of KHR10,900. PPWSA saw the biggest weekly gain of 0.8%, while PPAP and PAS shares edged down slightly over the week. GTI, PPSP, and PEPC shares closed unchanged from last Friday. On the growth board, DBDE and JSL shares were unmoved over the week. (Source: YSC Research)

Economy and Industry

Japanese investors looking to invest in Silk manufacturing in Cambodia The Ministry of Agriculture, Forestry and Fisheries (MAFF) and the Japan-Cambodia Association and Japanese investors in Cambodia are considering possibility in silk manufacturing partnership. According to the Minister of Agriculture Dith Tina, Japanese investors have studies Khmer silk and found that it contains high quality protein and can be used in cosmetics. He welcomes the potential cooperation and also appreciated the discussion bringing on board the private sector of both countries to discuss business and investment for mutual benefits. (Source: Khmer Times)

Local cement production meets 90% of demand There are five cement production units in Cambodia and together producing around 90% of the domestic demand, according to a recent Cambodian Cement Manufacturing Association (CCMA) report. The rest, 10% of demand, is met through imports, mainly from Vietnam, India and Germany. In the first 11 months of 2022, these five units toegther produced 7.7 million tons of cements, near their annual production capacity. While four cement plants are in Kampot province, the fifth unit is located in Battambang province. A sixth cement manufacturing unit in Kampong Speu is likely as a feasibility study is being conducted for it. (Source: Khmer Times)

Corporate News

Top Planning Japan eyeing investment in cashew nut process factory Japanese firm Top Planning Japan Co Ltd (TPJ) has expressed its interest in investing in facilities in Battambang province to convert cashew nut shells into fuel and process the fibre-rich seeds for export. TPJ boss Tetsuo Murayama unveiled these tentative plans on Feb 8. He commented that Cambodia can be seen as a major cashew nut producer, with annual output exceeding one million tonnes, but much of their economic potential is wasted as the bulk of the drupe seeds are sold to Vietnam, unprocessed. The Kingdom maybe able to export over $1bn worth of raw cashew nuts in a year, but TPJ could in theory process a portion of that and push that figure up as high as $3bn. The company's support will add value to the Kingdom's cashew nuts and better ensure the financial wellbeing of local farmers, he said. TPJ is also working with Chey Sambor Cashew Nut Processing Handicrafts in southwestern Kampong Thom province's Kampong Svay district to process cashew nuts for export to Japan. (Source: Phnom Penh Post)

| Stock Charts |

Main Board

Growth Board