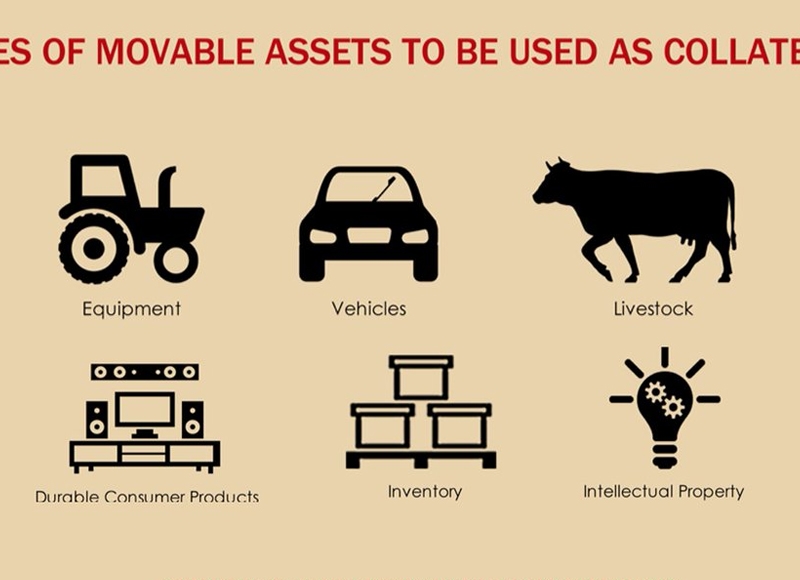

Legal framework needed for movable assets to be used as collateral

For movable assets to be used as collateral so that more Cambodian borrowers can have access to credit, a legal framework that would restrict changes in ownership and allow creditors to repossess collateral is needed, industry insiders say. Hout Ieng Tong, president and CEO of Hattha Kaksekar Ltd (HKL), said lenders deem movable assets too risky to accept as collateral given their liquidity. According to him, while lenders typically hold the title of property used as collateral until the debt is repaid, the absence of a secure ownership registration system for movable assets makes their use as a security guarantee problematic. Oeur Sothearoath, interim CEO of Credit Bureau Cambodia (CBC), the Kingdom’s only credit agency, said before the bank and MFIs will accept movable assets as collateral there must be a system in place that allows creditors to repossess the assets should a problem arise. However, he added that as a start, financial institutions should begin accepting movable assets from long-time customers with a good credit history or used in conjunction with fixed assets such as hard-titled real estate. The CBC database contains over 4 million credit histories, which can help identify when borrowers attempt to take out loans from multiple lenders. According to Sothearoath, 17% of the 3 million bank and MFI customers with outstanding loans have borrowed from more than one institution simultaneously. (Source: Phnom Penh Post)