Cambodia secures $1.8 billion in concessional loans

| News Highlights |

Economy and Industry

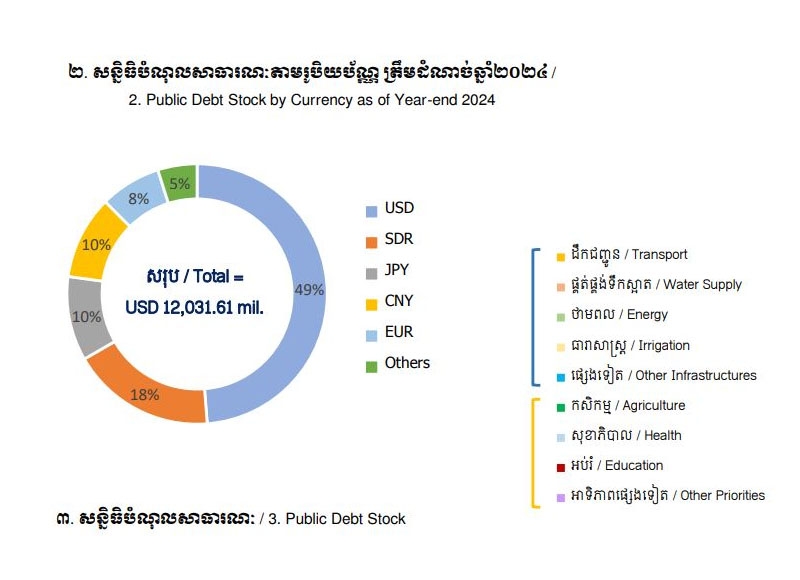

Cambodia secures $1.8 billion in concessional loans The Cambodian government has signed concessional loan agreements totaling $1.8 billion with various development partners in 2024, reflecting a 2% increase from the previous year. Approximately 39% of the loans were secured through bilateral agreements, while 61% came from multilateral partners. The funds will primarily target infrastructure development, including roads, bridges, and energy projects, as well as education, healthcare, and clean water initiatives. By focusing on these priority areas, Cambodia aims to foster inclusive economic growth and enhance public service delivery for its citizens. Despite the significant borrowing, the Ministry of Economy and Finance has assured that Cambodia's public debt remains manageable and sustainable, with the country adhering to prudent fiscal policies to maintain economic stability (Source: Khmer Times)

Cambodia-Malaysia economic ties strengthen in 2024 In 2024, trade and investment relations between Cambodia and Malaysia reached unprecedented levels, showcasing the growing partnership between the two ASEAN nations. Malaysia emerged as one of Cambodia's leading trading partners, with bilateral trade exceeding $632 million in 0224 constituting a 29% increase from the previous year - a milestone reflecting both nations' commitment to fostering economic growth. As Malaysia continues to support Cambodia's efforts to modernize its economy, the partnership exemplifies the potential for ASEAN countries to deepen economic integration and achieve mutual prosperity. The collaboration also emphasizes knowledge exchange, with Malaysia providing expertise in areas such as digital transformation and green energy. (Source: Khmer Times)

EU allocates 15 million euro to transform Cambodia's agriculture The European Union has granted Cambodia 15 million euro as part of an 80 million euro development package aimed at transforming the nation's agricultural sector and enhancing its export capabilities. The grant, under the ASPIRE-AT (Accelerating Inclusive Agriculture Value Chains in Cambodia) program, seeks to modernize agricultural practices, improve food security, and create new economic opportunities for smallholder farmers. By providing modern farming tools, improved irrigation systems, and access to international markets, the program is designed to increase productivity and reduce poverty in rural areas. Additionally, it includes a focus on empowering women, engaging youth, and supporting indigenous communities, fostering inclusive development. (Source: Khmer Times)

Corporate News

Chinese company to purchase 200,000 tonnes of Cambodian cassava COFCO Bio-Energy Co Ltd, a major Chinese state-owned food processing and trading conglomerate, has entered into a landmark agreement to purchase 200,000 tonnes of dried cassava from Cambodia, marking a significant boost for the country's agricultural sector. The deal highlights the rising global demand for Cambodian cassava, which is used in various industries to produce products like tapioca starch, animal feed, and ethanol. This agreement is expected to provide Cambodian farmers with stable incomes, encourage the cultivation of higher-quality cassava, and strengthen Cambodia's reputation as a reliable supplier in the global agricultural value chain. The partnership also underscores the growing economic ties between Cambodia and China, with cassava exports playing a vital role in diversifying Cambodia's trade portfolio. (Source: Khmer Times)

Stock Market

CSX index rises 0.29% amid mixed stock performance The CSX index rose by 0.29%, closing at 413.5 points. On the main board, CGSM (+0.41%), PEPC (+0.40%), PAS (+0.34%), PPAP (+0.28%), and ABC (+0.27%) posted gains, while PPSP (-0.46%) and GTI (-0.33%) recorded losses. PWSA and MJQE remained unchanged. On the growth board, DBDE was also unchanged, while JSL edged up by 0.33%. The session saw a total trading volume of 66,451 shares, with a turnover of KHR 436 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 413.46 | 0.29 | 66,451 | 11,090 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 6,340 | 0.00 | 0.96 | -0.31 | 6,360 | 6,240 | 65,565 | 551 |

| GTI | 6,020 | -0.33 | -0.33 | 18.50 | 6,140 | 6,020 | 45,372 | 241 |

| PPAP | 14,080 | 0.28 | -4.35 | 1.73 | 14,880 | 13,980 | 21,439 | 291 |

| PPSP | 2,180 | -0.46 | 1.40 | 0.46 | 2,190 | 2,150 | 27,310 | 157 |

| PAS | 11,900 | 0.34 | 0.51 | 2.94 | 11,900 | 11,640 | 5,757 | 1,021 |

| ABC | 7,320 | 0.27 | -0.27 | -2.92 | 7,400 | 7,180 | 299,779 | 3,171 |

| PEPC | 2,540 | 0.40 | 4.53 | 6.28 | 2,640 | 2,420 | 8,606 | 190 |

| MJQE | 2,120 | 0.00 | 0.47 | 1.92 | 2,120 | 2,090 | 40,966 | 687 |

| CGSM | 2,440 | 0.41 | 0.00 | 0.41 | 2,440 | 2,430 | 52,677 | 4,781 |

| DBDE | 2,100 | 0.00 | 0.48 | 1.94 | 2,110 | 2,060 | 13,947 | 39 |

| JSL | 3,060 | 0.33 | 0.33 | -10.53 | 3,080 | 3,030 | 2,973 | 79 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 3Q24 | 1,279 | 12,359 | 4.96 | 0.51 | 1.41 | 10.14 |

| GTI | 4Q24 | 48 | 7,057 | 125.42 | 0.85 | 0.72 | 22.95 |

| PPAP | 4Q24 | 2,550 | 22,115 | 5.52 | 0.64 | 1.72 | 3.47 |

| PPSP | 4Q24 | 220 | 3,866 | 9.92 | 0.56 | 2.95 | 5.19 |

| PAS | 4Q24 | 1,478 | 8,224 | 8.05 | 1.45 | 2.22 | 7.96 |

| ABC | 4Q24 | 1,140 | 13,790 | 6.42 | 0.53 | 0.97 | NA |

| PEPC* | 1Q25 | -1,009 | -17 | NA | -147.57 | 4.44 | NA |

| MJQE | 4Q24 | 37 | 307 | 57.11 | 6.91 | 4.19 | 12.71 |

| CGSM | 4Q24 | 52 | 606 | 46.91 | 4.02 | 6.82 | 16.17 |

| JSL | 4Q24 | 14 | 685 | 218.54 | 4.46 | 4.37 | 18.99 |

| DBDE | 4Q24 | 23 | 1,840 | 91.87 | 1.14 | 0.54 | 8.29 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *FY ending in June, **excluding non-voting shares | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| ABC32A | 0 | 0.0 | - - | khAA | Subordinated Bond | 8.50% | 2,503 |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability Bond | SOFR +3% or 5.5% per annum, whichever is higher | 3,165 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% Annually | 1,369 |

| GT27A | 0 | 0.0 | - - | N/A | Plain Bond, Green Bond | 7% per annum | 994 |

| PPSP29A | 0 | 0.0 | - - | KhAAA | Guaranteed Green Bond | Term SOFR + 1.5% | 1,556 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed Bond | 5.50% Annually | 23 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain Bond | 7% Annually | 2,764 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed Bond | SOFR+3,5% or 5% per annum (take which one is higher) | 1,011 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed Bond | SOFR+3,5% or 5% per annum (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% per annum (take which one is higher) | 2,838 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain Bond | 4.50% Annually | 526 |

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 5 Y | 10 Y | |

| Total issuance ('K units) | 204.1 | 312.0 | 85.3 | 10.0 | 0.0 |

| Outstanding (KHR'bn) | 34.0 | 240.0 | 85.3 | 10.0 | 0.0 |

| Issuance ('K units, Latest) | 24.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Coupon rate (Latest) | 2.80% | 3.20% | 3.80% | 4.75% | 5.25% |

| Successful yield (Latest) | 3.13% | - | - | - | |

| Latest bidding | 23-Jan-25 | 19-Feb-25 | 11-Dec-24 | 45,581 | 45,525 |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board