Cambodia CDC improves investment process with decentralization plan

| News Highlights |

Economy and Industry

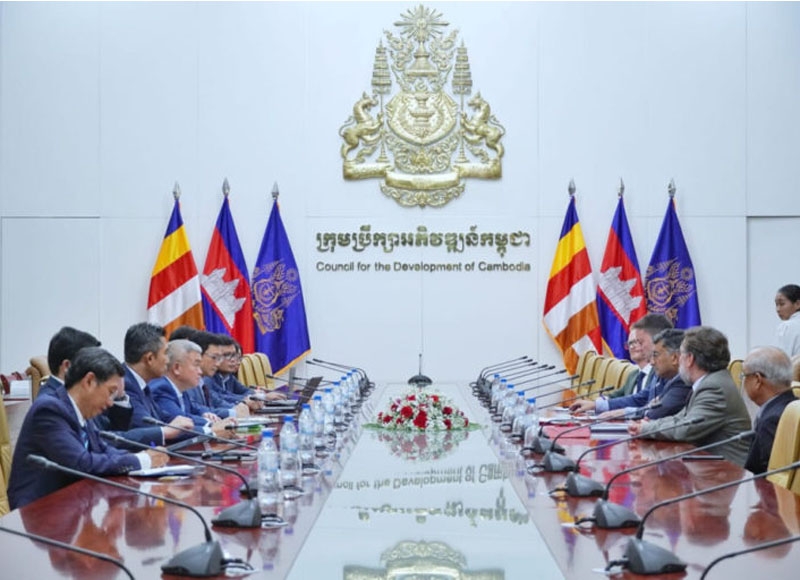

Cambodia CDC improves investment process with decentralization plan The Council for the Development of Cambodia (CDC) has embarked on a groundbreaking initiative to decentralize its investment registration process, aimed at enhancing accessibility, efficiency, and transparency through revisiting its data sharing systems and procedures for registering investment projects at the sub-national level through its Investment Project Management System (cdcIPM). The CDC plans to implement a user-friendly online platform that will streamline procedures, minimize bureaucratic hurdles, and provide investors with faster approvals. By decentralizing this process, the Cambodian government is signaling its commitment to fostering an investor-friendly environment that can attract both domestic and international businesses. (Source: Khmer Times)

Cambodia's exposure to potential U.S. tariffs raises concerns Cambodia remains at risk of being impacted by the reinstatement of tariffs under U.S. policies, particularly in the context of exports such as garments, footwear, and other products crucial to the country's economy as reported by a country risk analysis published by BMI, a Fitch Solutions Company. The analysis also altered its forecast of Cambodia's real GDP growth from 6.1% to 5.9% in 2025 citing the construction sector challenges. Diversification of export markets and an emphasis on regional economic collaborations could mitigate some of the vulnerabilities. Moreover, the analysis suggests that Cambodia's garment industry, which employs a significant portion of the population, must stay adaptive and competitive in a rapidly changing global economic environment. (Source: Khmer Times)

Green bonds to advance sustainable development in Cambodia Three companies are set to introduce green sustainability bonds in Cambodia, signaling a significant milestone in the country's journey toward environmentally friendly financing solutions. According to Sou Socheat, Director-General of the Securities and Exchange Regulator of Cambodia (SERC), one of the chosen companies plans to list its green bond by the end of this month, having successfully raised approximately $40 million. Meanwhile, the remaining two companies are currently working on issuing their sustainability bonds. These bonds aim to generate funding for projects focused on reducing environmental impact, enhancing energy efficiency, and promoting long-term sustainability. The issuance aligns with global trends where financial markets are increasingly prioritizing climate-conscious investments. (Source: Khmer Times)

Corporate News

Smart Axiata and Huawei partner to drive Cambodia's digital progress Telecommunications company Smart Axiata has joined forces with Huawei Cambodia to develop advanced business solutions designed to empower local industries through digital transformation. This partnership focuses on integrating cutting-edge technologies such as 5G, artificial intelligence (AI), and cloud computing to enhance efficiency, productivity, and innovation across various sectors, including manufacturing, finance, and services. By enabling small and medium-sized enterprises (SMEs) to access state-of-the-art tools and solutions, the collaboration aims to strengthen Cambodia's digital economy and boost its competitiveness on a global scale. This endeavor underscores the potential of strategic partnerships in accelerating technological progress and supporting local industries in their digital transformation journeys. (Source: Cambodian Investment Review)

Stock Market

CSX index drops to 413.3 points; trading volume at 42k shares The CSX index declined by 0.08%, closing at 413.3 points. On the main board, no stocks posted gains, while GTI (-1.31%), PPSP (-0.92%), PPAP (-0.71%), PEPC (-0.38%), and PWSA (-0.31%) recorded losses. PAS, ABC, MJQE, and CGSM remained unchanged. On the growth board, both DBDE and JSL also remained unchanged. The session recorded a total trading volume of 41,516 shares, with a turnover of KHR 281 million. (Source: YSC Research)

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 413.28 | 0.08 | 41,516 | 11,085 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 6,340 | -0.31 | 0.96 | -0.31 | 6,360 | 6,240 | 42,157 | 551 |

| GTI | 6,020 | -1.31 | -0.33 | 18.50 | 6,140 | 5,580 | 34,137 | 241 |

| PPAP | 14,080 | -0.71 | -4.35 | 1.73 | 14,880 | 14,020 | 7,980 | 291 |

| PPSP | 2,160 | -0.92 | 0.47 | -0.46 | 2,180 | 2,150 | 11,782 | 155 |

| PAS | 11,800 | 0.00 | -0.34 | 2.08 | 11,900 | 11,640 | 3,690 | 1,012 |

| ABC | 7,320 | 0.00 | -0.27 | -2.92 | 7,400 | 7,180 | 170,796 | 3,171 |

| PEPC | 2,610 | -0.38 | 7.41 | 9.21 | 2,640 | 2,400 | 4,119 | 196 |

| MJQE | 2,120 | 0.00 | 0.47 | 1.92 | 2,120 | 2,080 | 30,829 | 687 |

| CGSM | 2,440 | 0.00 | 0.00 | 0.41 | 2,440 | 2,420 | 31,167 | 4,781 |

| DBDE | 2,110 | 0.00 | 0.96 | 2.43 | 2,110 | 2,060 | 10,532 | 39 |

| JSL | 3,050 | 0.00 | 0.00 | -10.82 | 3,080 | 3,040 | 2,306 | 78 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 3Q24 | 1,279 | 12,359 | 4.96 | 0.51 | 1.41 | 10.14 |

| GTI | 4Q24 | 48 | 7,057 | 125.42 | 0.85 | 0.72 | 22.95 |

| PPAP | 4Q24 | 2,550 | 22,115 | 5.52 | 0.64 | 1.72 | 3.47 |

| PPSP | 4Q24 | 220 | 3,866 | 9.83 | 0.56 | 2.92 | 5.14 |

| PAS | 4Q24 | 1,478 | 8,224 | 7.99 | 1.43 | 2.20 | 7.91 |

| ABC | 4Q24 | 1,140 | 13,790 | 6.42 | 0.53 | 0.97 | NA |

| PEPC* | 1Q25 | -1,009 | -17 | NA | -151.63 | 4.56 | NA |

| MJQE | 4Q24 | 37 | 307 | 57.11 | 6.91 | 4.19 | 12.71 |

| CGSM | 4Q24 | 52 | 606 | 46.91 | 4.02 | 6.82 | 16.17 |

| JSL | 4Q24 | 14 | 685 | 217.82 | 4.45 | 4.36 | 18.96 |

| DBDE | 4Q24 | 23 | 1,840 | 92.31 | 1.15 | 0.55 | 8.33 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *FY ending in June, **excluding non-voting shares | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| ABC32A | 0 | 0.0 | - - | khAA | Subordinated Bond | 8.50% | 2,510 |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability Bond | SOFR +3% or 5.5% per annum, whichever is higher | 3,172 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% Annually | 1,376 |

| GT27A | 0 | 0.0 | - - | N/A | Plain Bond, Green Bond | 7% per annum | 1,001 |

| PPSP29A | 0 | 0.0 | - - | KhAAA | Guaranteed Green Bond | Term SOFR + 1.5% | 1,563 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed Bond | 5.50% Annually | 30 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain Bond | 7% Annually | 2,771 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed Bond | SOFR+3,5% or 5% per annum (take which one is higher) | 1,018 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed Bond | SOFR+3,5% or 5% per annum (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% per annum (take which one is higher) | 2,845 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain Bond | 4.50% Annually | 533 |

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 5 Y | 10 Y | |

| Total issuance ('K units) | 204.1 | 312.0 | 85.3 | 10.0 | 0.0 |

| Outstanding (KHR'bn) | 34.0 | 240.0 | 85.3 | 10.0 | 0.0 |

| Issuance ('K units, Latest) | 24.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Coupon rate (Latest) | 2.80% | 3.20% | 3.80% | 4.75% | 5.25% |

| Successful yield (Latest) | 3.13% | - | - | - | |

| Latest bidding | 23-Jan-25 | 19-Feb-25 | 11-Dec-24 | 45,581 | 45,525 |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| Stock Charts |

Main Board

Growth Board