Estimation of Cambodia's Sovereign Yields & Credit Spreads

/ May 16, 2024

- Sovereign yield data serve various purposes. They not only provide insights into economic conditions, investor sentiment, and government creditworthiness, but also allow investors to price corporate bonds and to evaluate performance of any other investments made within a country.

-

While the Cambodian government, represented by the Ministry of Economy and Finance (MEF), has launched the government bond market through the National Bank of Cambodia (NBC)'s platform, allowing banking and financial institutions (FIs) to bid and purchase the government bonds, the Cambodian sovereign yield data obtained so far may not be informative and useful for the purposes mentioned above due to the following reasons:

- The government bonds have been denominated only in KHR. Given the high level of dollarization in Cambodia, the sovereign yields in USD are still needed and should be more useful.

- There has been very limited investor participation in the primary market since (1) the platform has so far been made directly accessible mainly to FIs under the regulatory supervision of the NBC; (2) the KHR-denominated securities limits investor participation, as only a handful of FIs have surplus KHR liquidity, while many others have been facing shortages of the KHR liquidity.

- As the NBC platform has yet to allow the secondary market trading, the only available data is the primary market data with very low frequency.

- The issued tenors so far have been limited to short term of 1-3 year (based on disclosed information).

- The sovereign yield data from the primary market bidding process may not reflect the market price due to the: 1) small issue amounts, 2) limited investor participation, 3) adoption of multiple pricing methods, and 4) MEF's discretion to terminate planned issuances if the bidding yields are unsatisfactory.

- In response to the above challenges, we attempt to derive theoretical USD-denominated sovereign yields for Cambodia. These yields could serve as a reference for pricing corporate/project bonds issued in Cambodia, and for evaluating the performance of investments made in the country. Our approach uses readily accessible data on a daily basis, allowing for the regular updates and publication of the theoretical sovereign yields on our Website and Linkedin.

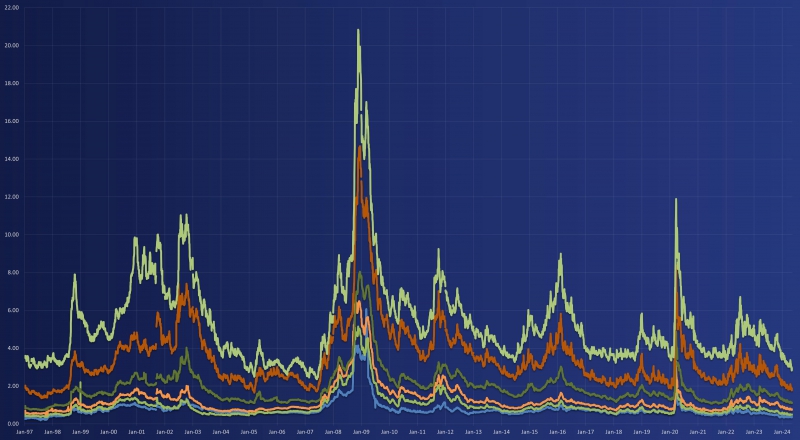

- In this report, we demonstrate the methodology for deriving Cambodia's USD-denominated sovereign yields (both fixed and floating) based on Thai sovereign yields, TRIS' rating of Cambodia, Thai corporate bond spreads, USD-THB cross-currency swaps, and SOFR swap rates. We used the Thai market data instead of the international USD-denominated corporate yields data due to (1) the availability and accessibility of the relevant Thai corporate spreads for different tenors; (2) high sample variance of the single B+ or B USD-denominated corporate yields because the high-yield bonds generally have low marketability, and the international rating scale does not provide sufficient rating granularity compared to the Thai national scale.

- Download the synthetic sovereign yield curve data here.