Cambodia sees surge in online business registrations

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 414.58 | 0.20 | 219,171 | 11,120 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,120 | 0.28 | 1.71 | -2.20 | 7,220 | 7,000 | 37,708 | 619 |

| GTI | 2,330 | -0.43 | 3.56 | -17.96 | 2,360 | 2,180 | 15,969 | 93 |

| PPAP | 13,180 | 0.00 | 1.70 | -5.86 | 13,200 | 12,380 | 6,208 | 273 |

| PPSP | 2,030 | 0.00 | -0.98 | -6.88 | 2,080 | 2,030 | 79,002 | 146 |

| PAS | 12,400 | -0.48 | -0.16 | -1.43 | 12,480 | 12,140 | 1,746 | 1,064 |

| ABC | 7,720 | 0.52 | 1.58 | -23.26 | 8,720 | 7,420 | 1,075,698 | 3,344 |

| PEPC | 2,170 | -0.46 | 1.88 | -20.80 | 2,510 | 2,130 | 2,488 | 163 |

| MJQE | 2,210 | 1.38 | 0.45 | 3.76 | 2,230 | 2,060 | 691,887 | 716 |

| CGSM | 2,400 | 0.00 | 0.84 | -8.75 | 2,490 | 2,370 | 115,288 | 4,702 |

| DBDE | 2,180 | 0.00 | 4.31 | 1.87 | 2,190 | 2,080 | 56,836 | 40 |

| JSL | 3,980 | 0.00 | 6.13 | -9.55 | 3,980 | 3,670 | 10,396 | 102 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 4Q23 | 1,456 | 16,034 | 4.89 | 0.44 | 1.60 | 8.38 |

| GTI | 4Q23 | 109 | 7,145 | 21.39 | 0.33 | 0.28 | 9.96 |

| PPAP* | 4Q23 | 1,534 | 38,520 | 8.59 | 0.34 | 1.92 | 4.76 |

| PPSP | 4Q23 | 451 | 3,530 | 4.50 | 0.58 | 0.57 | 3.50 |

| PAS* | 4Q23 | 1,422 | 11,333 | 8.72 | 1.09 | 2.92 | 7.60 |

| ABC | 4Q23 | 1,207 | 13,033 | 6.39 | 0.59 | 0.98 | NA |

| PEPC** | 4Q23 | -477 | 842 | NA | 2.58 | 3.81 | 62.88 |

| MJQE | 4Q23 | 59 | 297 | 37.53 | 7.45 | 4.79 | 14.78 |

| CGSM | 4Q23 | 166 | 563 | 14.44 | 4.26 | 6.29 | 15.18 |

| JSL | 4Q23 | 274 | 593 | 14.51 | 6.71 | 1.48 | NA |

| DBDE | 4Q23 | 221 | 1,883 | 9.87 | 1.16 | 0.47 | 6.54 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,476 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,680 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,305 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 334 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,075 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,322 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,149 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 837 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,694 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 180.1 | 292.0 | 22.0 | - | - |

| Outstanding (KHR'bn) | 80.0 | 292.0 | 22.0 | - | - |

| Issuance ('K units, Latest) | 10.0 | 140.0 | 6.0 | - | - |

| Coupon rate (Latest) | 3.50% | 4.50% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 5.13% | 4.75% | - | - |

| Latest bidding | 24-Apr-24 | 20-Mar-24 | 20-Dec-23 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| News Highlights |

Stock Market

CSX index gains 0.20% to 414.6 points On May 10, 2024, the CSX index closed trading at 414.6 points, marking a 0.20% increase from the previous day. Main board activity showed mixed results, with gains in MJQE (+1.38%), ABC (+0.52%), and PWSA (+0.28%) while PAS (-0.48%), PEPC (-0.46%), and GTI (-0.43%) experienced declines. PPAP, PPSP, and CGSM remained unchanged. On the growth board, DBDE and JSL closed unchanged from opening price. Total trading volume reached 219,171 shares, with a cumulative trading value of KHR 1,036 million. (Source: YSC Research)

Economy and Industry

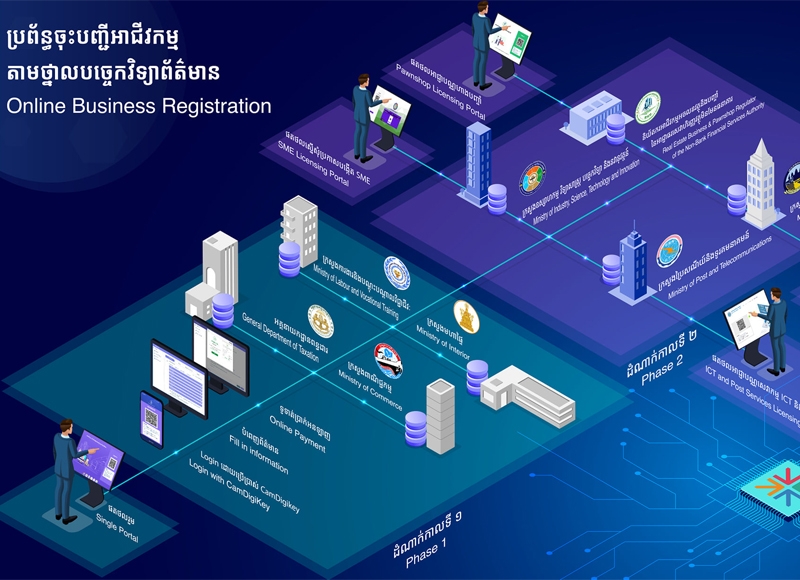

Cambodia sees surge in online business registrations As of May 5th 2024, a total of 35,829 businesses with a capital of $10.22 billion have been registered through the Online Business Registration platform, known as the Single Portal-Phase 1, according to an official report. The system has reserved 19,094 company names, with only two applications rejected. The construction sector leads in investment with 10.8%, followed by real estate, accommodation services, consulting services, manufacturing, and mixed sectors. Women-led businesses represent 38% of total online business registration. The platform, launched in June 2020, has streamlined business registration processes, reducing time and cost, contributing to investor confidence. The surge in registrations reflects the country's reopening and revitalized socio-economic activities under government policies, noted Lim Heng, Vice President of the Cambodian Chamber of Commerce. (Source: Khmer Times)

Cambodia's agricultural exports increase to $2.35 billion in 1Q24 According to the Ministry of Agriculture, Forestry, and Fisheries, Cambodia saw a significant surge in agricultural exports, totaling $2.35 billion in 1Q24, a 74% increase YoY. In addition, agricultural products increased by 2.2 million tons from the prior period. Key exports included rice, bananas, cassava, cashew nuts, pepper, and tobacco. Milled rice and paddy rice exports earned $210 million and $364 million, respectively, while other agricultural products amounted to $1.79 billion. Major importers included China, the EU, Vietnam, and Thailand. Minister Tith Dina advocated for modern farming communities to boost profit. Furthermore, three ministries announced plans to collaborate on water supply and irrigation development to support farmers and rural livelihoods. (Source: Khmer Times)

Cambodia approves 128 investment projects in the first quarter During the inauguration of the Cambodia Confederation of Investors Association (CCIA), Prime Minister Hun Manet announced the approval of 128 new investment and expansion projects in 1Q24, with a total investment exceeding $2.5 billion and the creation of over 130,000 jobs. He emphasized the collaborative effort between the Royal Government and the private sector to collectively attract investors to Cambodia. Additionally, the PM highlighted the recent signing of 14 investment projects worth $480 million, showcasing the government's commitment to promoting Cambodia and fostering investor trust. The PM underscored the dual approach of Cambodia's investment strategy: retaining existing investments while cultivating new ones. (Source: Khmer Times)

Corporate News

Hafele opens shop in Cambodia Hafele, a global leader in hardware and fitting systems, has embarked on its Cambodian market entry, capitalizing on the country's burgeoning tourism industry and rising middle-class population. With a strategic focus on furniture fittings, door ironmongery, appliances, and sanitary wares, Hafele aims to seize opportunities in both residential and hotel projects. This expansion aligns with Hafele's broader regional strategy, emphasizing relationship-building and pioneering efforts in emerging markets. With a reputation for innovative solutions and sustainability, Hafele is poised to contribute to the development of livable and sustainable environments in Cambodia under the leadership of Managing Director Stanislas Hug and Regional Director Dominik Fruth. (Source: Cambodia Investment Review)

| Stock Charts |

Main Board

Growth Board