Cambodia's trade with ASEAN nation surges

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 434.14 | -0.24 | 70,775 | 11,644 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,180 | -0.28 | -1.10 | -1.37 | 7,260 | 7,160 | 28,761 | 624 |

| GTI | 2,360 | 0.00 | -13.24 | -16.90 | 2,790 | 2,310 | 55,996 | 94 |

| PPAP | 12,680 | 0.00 | -4.08 | -9.43 | 13,500 | 12,680 | 2,626 | 262 |

| PPSP | 2,040 | -1.92 | -1.45 | -6.42 | 2,090 | 2,040 | 36,796 | 147 |

| PAS | 12,280 | 0.49 | -0.81 | -2.38 | 12,520 | 12,220 | 6,549 | 1,053 |

| ABC | 8,640 | -0.69 | -10.56 | -14.12 | 9,800 | 8,640 | 737,320 | 3,743 |

| PEPC | 2,460 | 6.03 | 2.93 | -10.22 | 2,630 | 2,320 | 1,562 | 184 |

| MJQE | 2,090 | 0.97 | 0.97 | -1.88 | 2,090 | 2,060 | 137,017 | 677 |

| CGSM | 2,480 | -0.40 | -2.75 | -5.70 | 2,570 | 2,480 | 65,373 | 4,859 |

| DBDE | 2,120 | -0.47 | 1.44 | -0.93 | 2,140 | 2,080 | 20,363 | 39 |

| JSL | 3,860 | 2.39 | -2.53 | -12.27 | 4,000 | 3,720 | 743 | 99 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA* | 2Q23 | 1,382 | 15,172 | 5.20 | 0.47 | 1.08 | 5.50 |

| GTI | 2Q23 | 95 | 7,181 | 24.72 | 0.33 | 0.26 | 10.26 |

| PPAP* | 2Q23 | 2,412 | 38,041 | 5.26 | 0.33 | 1.87 | 4.61 |

| PPSP | 2Q23 | 489 | 3,576 | 4.17 | 0.57 | 0.64 | 3.69 |

| PAS* | 2Q23 | 1,191 | 11,029 | 10.31 | 1.11 | 3.17 | 8.08 |

| ABC | 2Q23 | 1,608 | 12,485 | 5.37 | 0.69 | 1.15 | NA |

| PEPC** | 2Q23 | -312 | 1,220 | NA | 2.02 | 2.32 | 32.28 |

| MJQE | 2Q23 | 29 | 289 | 72.54 | 7.22 | 5.51 | 17.36 |

| CGSM | 2Q23 | 98 | 392 | 25.42 | 6.32 | 6.23 | 14.94 |

| JSL | 2Q23 | -239 | 185 | NA | 20.82 | NA | NA |

| DBDE | 2Q23 | 76 | 1,919 | 28.02 | 1.10 | 0.52 | 11.56 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| Corporate Bonds |

Trading Summary

| Bond Symbol | Trading Vol (Units) | Trading Val (KHR'mn) | Latest Yield | Credit Rating | Bond Feature | Coupon Rate (%) | Days to Maturity |

| CGSM33A | 0 | 0.0 | - - | KhAAA | Sustainability | Floating* | 3,499 |

| CIAF28A | 0 | 0.0 | - - | KhAAA | N/A | 6.30% | 1,703 |

| GT27A | 0 | 0.0 | - - | N/A | Plain , Green | 7.00% | 1,328 |

| RMAC25A | 0 | 0.0 | - - | N/A | Guaranteed | 5.50% | 357 |

| RRC32A | 0 | 0.0 | - - | N/A | Plain | 7.00% | 3,098 |

| RRGO27A | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating** | 1,345 |

| RRGT32B | 0 | 0.0 | - - | KhAAA | Guaranteed | Floating*** | 3,172 |

| TCT26A | 0 | 0.0 | - - | N/A | Plain | 4.50% | 860 |

| TCT28A | 0 | 0.0 | - - | KhAAA | FX-Linked | Floating**** | 1,717 |

| *SOFR +3% or 5.5% , whichever is higher; **SOFR+3,5% or 5% (take which one is higher);***SOFR+3,5% or 5% (take which one is higher) and Year 6 to Year 10: SOFR+3,75% or 5% (take which one is higher);****Term SOFR + 2.5% | |||||||

| Government Bonds |

Historical Issuance Summary

| 1 Y | 2 Y | 3 Y | 10 Y | 15 Y | |

| Total issuance ('K units) | 170.1 | 292.0 | 22.0 | - | - |

| Outstanding (KHR'bn) | 74.0 | 292.0 | 22.0 | - | - |

| Issuance ('K units, Latest) | 22.0 | 140.0 | 6.0 | - | - |

| Coupon rate (Latest) | 3.50% | 4.50% | 4.50% | - | - |

| Successful yield (Latest) | 3.85% | 5.13% | 4.75% | - | - |

| Latest bidding | 24-Jan-24 | 20-Mar-24 | 20-Dec-23 | - | - |

| *Total issuance is the accumulated issuance since September 2022; **Outstanding is aggregate principal value of government that remain outstanding; ***Successful yield: mid yields are shown if multiple price auction method was adopted. | |||||

| News Highlights |

Stock Market

Mixed activity on main board and growth board On April 17, 2024, the CSX index wrapped up the trading session at 434.1 points, a decline of 0.24% compared to the previous day's close. Market activity on the main board showed a mixed picture, with notable advances in PEPC (+6.03%), MJQE (+0.97%), and PAS (+0.49%). Conversely, PPSP (-1.92%), PAS (-0.69%), CGSM (-0.40%), and PWSA (-0.28%) declined. GTI and PPAP ended the day unchanged from their opening prices. On the growth board, DBDE was down 0.47%, while JSL posted a solid uptick of 2.39%. Total trading volume for the day amounted to 70,775 shares, with a cumulative trading value reaching KHR 498 million. (Source: YSC Research)

Economy and Industry

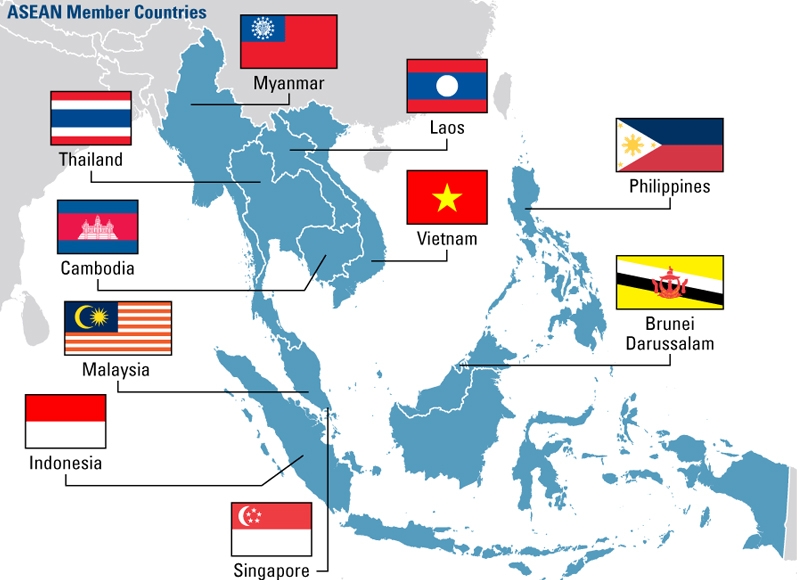

Cambodia's trade with ASEAN nation surges According to a report from the Ministry of Commerce, Cambodia's cross-border trade with other ASEAN countries surged by 18.64% to $4.32 billion in 1Q24. In the first quarter of this year, the Kingdom exported $1.77 billion worth of goods to other ASEAN countries, a 33.1% increase YoY. On the other hand, the Kingdom imported a total of $2.55 billion, a 10.31% increase, from other ASEAN countries. Vietnam and Thailand lead the way in terms of trade volumes with a value of $2.32 billion and $1.12 billion, respectively. Notable exports to ASEAN countries include agricultural products, clothes, footwear, travel goods, electronics, and bicycles, while imports include food items, beverages, electrical and electronic equipment, construction materials, agricultural machinery, and vehicles. (Source: Khmer Times)

Garment sector exports increase by 20% As reported by the Ministry of Commerce, Cambodia's garment, footwear, and travel products (GFTs) exports witnessed a significant surge in the first quarter of 2024, reaching $2,941 million, marking a 20% increase from the same period last year. Apparel and textiles contributed $2,167 million, footwear represented $346.3 million, and travel goods accounted for $427.9 million, reflecting respective growth rates of 23%, 6.9%, and 16.6%. Poullang Doung from the Asian Development Bank-Cambodia highlighted the positive outlook for the GFT sector, which will partly contribute to Cambodia's forecasted economic growth of 5.8% in 2024. The GFT industry, consisting of approximately 1,680 factories and branches and employing around 918,000 workers, remains a key foreign exchange earner for Cambodian women. (Source: Khmer Times)

Cambodia aims to surpass pre-pandemic tourism levels by 2025 Cambodia is actively seeking the return of international tourists, especially Chinese tourists, in a bid to revive its post-pandemic tourism industry. Tang Sochetkresna, Director of Department of Tourism in Preah Sihanouk, hopes that more foreign tourists will visit the coastal province, highlighting the province's appeal with its physical infrastructure, natural beauty, and tourism services. Furthermore, he urges the Chinese government, EU member countries, and ASEAN to encourage airline companies to resume direct flights to Cambodia after their suspension during the Covid-19 pandemic. The province has organized celebratory activities during the traditional New Year and is prepared to welcome tourists with cultural performances. Local vendors, like Seong Changtha, rely on tourism for income and anticipates increased business with more visitors, particularly from China. With security and cleanliness, tourists like Uy Meyta praise the province's attractions. Cambodian PM Hun Manet aims to surpass pre-pandemic tourism levels by 2025, cementing tourism as one of the four pillars support Cambodia's economy. (Source: Khmer Times)

Corporate News

Wing Bank and Japan Money Express sign MoU to expand remittance channels Wing Bank (Cambodia) Plc and Japan Money Express (JME) have inked a memorandum of understanding (MoU) to broaden remittance options for Cambodians residing in Japan. With around 30,000 Cambodian nationals living and working in Japan, the collaboration aims to offer a reliable, secure, and cost-effective method for them to send money back to their families in Cambodia. Through this partnership, Cambodians in Japan can utilize JME's services to transfer funds directly to Wing Bank accounts in Cambodia, facilitating convenient access for their recipients. The initiative underscores the commitment of both institutions to promote financial inclusivity and streamline international transactions, ensuring that hard-earned income reaches families back home efficiently and affordably. (Source: Khmer Times)

| Stock Charts |

Main Board

Growth Board