Four Asian countries, including Cambodia, are driving the diversification of US chips

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 495.26 | 0.29 | 91,185 | 7,511 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,780 | 0.00 | 0.26 | 2.91 | 7,920 | 7,620 | 8,418 | 677 |

| GTI | 3,390 | 0.00 | 0.59 | -10.79 | 3,540 | 3,330 | 10,883 | 136 |

| PPAP | 14,880 | -0.13 | 0.54 | 6.29 | 15,100 | 14,720 | 1,473 | 308 |

| PPSP | 2,370 | -0.42 | 0.42 | -0.84 | 2,400 | 2,350 | 23,754 | 170 |

| PAS | 13,800 | -0.14 | 0.15 | 3.60 | 13,960 | 13,660 | 1,673 | 1,184 |

| ABC | 11,100 | 0.54 | 0.54 | 2.59 | 11,300 | 10,980 | 239,241 | 4,808 |

| PEPC | 3,060 | -0.65 | -0.65 | -2.86 | 3,140 | 3,060 | 987 | 229 |

| DBDE | 2,360 | 0.00 | 0.43 | -1.26 | 2,400 | 2,350 | 14,062 | 44 |

| JSL | 4,560 | 0.44 | 0.00 | -8.06 | 4,660 | 4,540 | 49,346 | 117 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 3Q22 | 1,242 | 9,852 | 6.26 | 0.79 | 1.95 | 8.44 |

| GTI | 3Q22 | 178 | 7,138 | 19.07 | 0.47 | 0.30 | 66.51 |

| PPAP | 3Q22 | 2,897 | 18,416 | 5.14 | 0.81 | 2.08 | 5.63 |

| PPSP | 3Q22 | 328 | 3,576 | 7.21 | 0.66 | 0.98 | 16.55 |

| PAS | 3Q22 | 1,568 | 5,986 | 8.80 | 2.31 | 3.34 | 14.84 |

| ABC | 3Q22 | 1,702 | 12,067 | 6.52 | 0.92 | 1.65 | NA |

| PEPC** | 2Q22 | 33 | 1,468 | 92.85 | 2.08 | 1.06 | 25.63 |

| DBDE | 3Q22 | -123 | 1,426 | NA | 1.66 | 0.71 | 2.56 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| News Highlights |

Stock Market

CSX index closes the first week of April up 0.4% On April 7, 2023, the CSX index improved to 495.3 points, posting a weekly gain of 0.4%. PPAP, PPSP, PAS, and PEPC shares edged down 0.13%, 0.42%, 0.14%, and 0.65%, respectively. The shares of PWSA and GTI were unchanged, while today only ABC on the main board posted a daily gain of 0.54% to finish KHR11,100. JSL on the growth board edged up 0.44% to KHR4,560, while DBDE's stock showed no movement. 91,185 shares changed hands, up 81.8% over the previous day's volume. (Source: YSC Research)

Economy and Industry

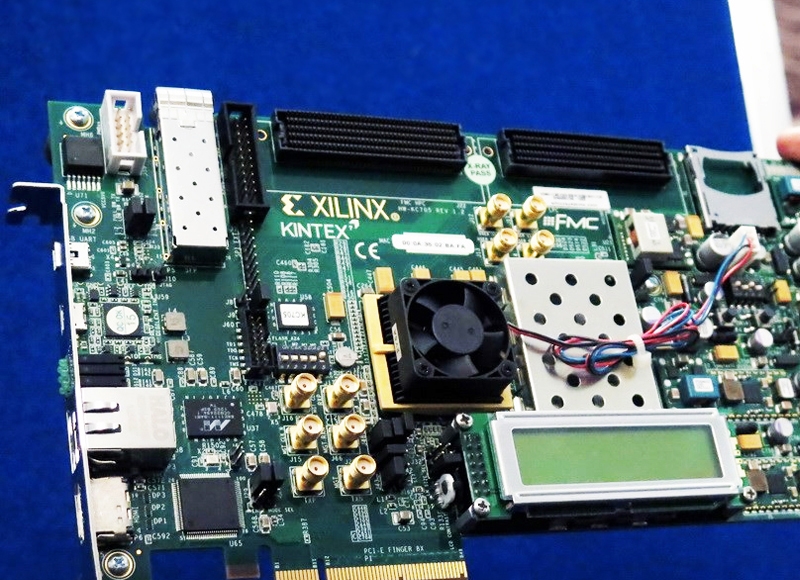

Four Asian countries, including Cambodia, are driving the diversification of US chips This year's early winners from US efforts to protect its semiconductor supply chain include Thailand, Vietnam, India, and Cambodia. According to the US Census data, semiconductor imports into the US increased 17% from the previous year to $4.86 billion in February, with Asia accounting for 83% of that amount. India had a 34-fold increase in semiconductor sales to $152 million, while Cambodia experienced an amazing 698% growth and came up just short of Japan with $166 million-a sum previously unheard of. Deteriorating relations between Washington and China have compelled each country to reassess its supply of semiconductors, which are an essential smart component in everything from computers and phones to home appliances. (Source: Khmer Times)

Local banks raising lending rates to reflect US Fed's rising policy rate Chea Serey, deputy governor of the National Bank, urged the use of more riel currency as the best weapon for the financial policy and said that some local banks are trying to raise the interest rates on the loans they make to their clients in response to the US Fed's hike in interest rates. In March of last year, the Federal Reserve increased the benchmark interest rate, which caused interest rates all around the world to rise. On loans to consumers, some local banks are beginning to increase their interest rates by at least 0.5 percent annually. Cathay United Bank and SBI LY HOUR Bank are the local banks that have begun hiking interest rates for consumers. This change will take effect in April 2023. (Source: Khmer Times)

Neighbor visitors increased seven-fold in first two months of 2023 According to the tourism ministry, Cambodia welcomed 447,186 foreign tourists in the first two months of 2023 from Laos, Thailand, and Vietnam, an increase of 746.32% YoY from 52,839 and even 59.73% from 279,968 in the same time of 2019. In the early stages of the post-Covid-19 tourism recovery, the local business must rely largely on regional countries, notably the trio of bordering countries, according to Chhay Sivlin, head of the Cambodia Association of Travel Agents (CATA). She pointed out that Laos, Thailand, and Vietnam are important source markets for travelers due to their comparatively efficient Covid administration, proximity to Cambodia, and ease of cross-border travel. (Source: The Phnom Penh Post)

Corporate News

The SSCA inspects Cambodia's first aviation academy for compliance The first flight training facility in Cambodia, Novation Academy, was thoroughly inspected by the State Secretariat of Civil Aviation (SSCA) to confirm that it complied with all legal criteria. The aviation industry's development in the nation and the area has advanced thanks to this inspection. The inspection's main goals were to make sure Novation Academy was following SSCA regulations and international aviation standards as well as to make sure the school is properly preparing the future generation of Cambodian pilots. The 2-seat Magnus Fusion 212 is anticipated to be delivered to Novation Academy in the upcoming months, and it will be used for training right away. In the academy's quest to emerge as the top aviation training facility in the area, this acquisition represents another significant turning point. (Source: Cambodia Investment Review)

| Stock Charts |

Main Board

Growth Board