Cambodia-Japan bilateral trade up 12% YoY in 2022

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 487.87 | -0.02 | 54,954 | 7,399 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,740 | -0.51 | 2.38 | 2.38 | 7,780 | 7,460 | 56,556 | 673 |

| GTI | 3,670 | -0.27 | -3.42 | -3.42 | 3,800 | 3,600 | 30,657 | 147 |

| PPAP | 14,400 | 0.56 | 2.86 | 2.86 | 14,500 | 13,980 | 19,372 | 298 |

| PPSP | 2,410 | 0.42 | 0.84 | 0.84 | 2,410 | 2,360 | 106,299 | 173 |

| PAS | 13,720 | 0.00 | 3.00 | 3.00 | 13,760 | 13,140 | 22,086 | 1,177 |

| ABC | 10,840 | 0.00 | 0.18 | 0.18 | 10,860 | 10,680 | 572,067 | 4,695 |

| PEPC | 3,150 | 0.00 | 0.00 | 0.00 | 3,190 | 3,140 | 3,549 | 236 |

| DBDE | 2,420 | 0.00 | 1.26 | 1.26 | 2,430 | 2,370 | 38,538 | 45 |

| JSL | 4,800 | -0.41 | -3.23 | -3.23 | 4,960 | 4,800 | 10,561 | 123 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 3Q22 | 1,242 | 9,852 | 6.23 | 0.79 | 1.94 | 8.42 |

| GTI | 3Q22 | 178 | 7,138 | 20.65 | 0.51 | 0.32 | 71.02 |

| PPAP | 3Q22 | 2,897 | 18,416 | 4.97 | 0.78 | 2.01 | 5.48 |

| PPSP | 3Q22 | 328 | 3,576 | 7.34 | 0.67 | 1.00 | 16.75 |

| PAS | 3Q22 | 1,568 | 5,986 | 8.75 | 2.29 | 3.32 | 14.77 |

| ABC | 3Q22 | 1,702 | 12,067 | 6.37 | 0.90 | 1.61 | NA |

| PEPC** | 2Q22 | 33 | 1,468 | 95.58 | 2.15 | 1.09 | 25.99 |

| DBDE | 3Q22 | -123 | 1,426 | NA | 1.70 | 0.73 | 2.62 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| News Highlights |

Stock Market

CSX index retreats for second straight day On Jan 17, 2023, the CSX index edged down 0.02% from the previous close to 487.9pts, retreating for the second day straight. PPWSA and GTI shares were down 0.51% and 0.27% to KHR7,740 and KHR3,670, respectively. Meanwhile, PPAP shares rose 0.56% to KHR14,400, while PPSP shares gained 0.42% to end at KHR2,410. The other stocks on the main board remained unchanged. On the growth board, JSL shares dropped 0.41% to KHR4,800, while DBDE shares were moved. (Source: YSC Research)

Economy and Industry

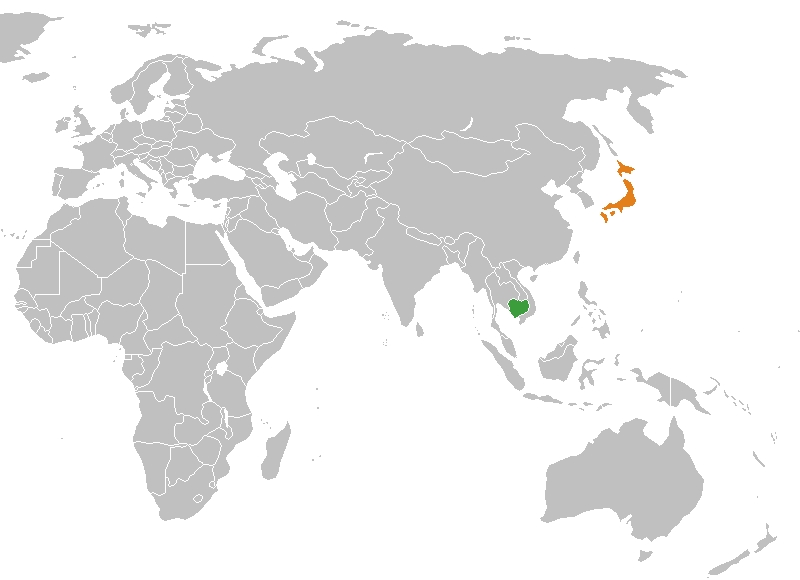

Cambodia-Japan bilateral trade up 12% YoY in 2022 The bilateral merchandise trade between Cambodia and Japan reached $1.95bn in 2022, up 12% YoY, according to the General Department of Customs and Excise (GDCE). Last year, Cambodian good exports to Japan amounted to $1.17bn, up 7.3%, while imports from Japan were $775mn, up 21.0% YoY. Cambodia's trade surplus with Japan narrowed to $398mn vs $453mn in 2021. Japan was the fourth largest buyer of Cambodian merchandise in 2022, accounting for 5.2% of the global total of $22.5bn. (Source: Phnom Penh Post)

Credit and deposits see double-digit growth in 2022 Cambodia's banking and financial institutions posted a solid growth last year despite regional and global economic uncertainty and inflationary pressures. Credit to private sector increased by 21%, while customer deposits rose 11.3%, the National Bank of Cambodia said in its "Macroeconomic and Banking Sector Development in 2022 and Outlook for 2023". "Prudential regulations, which were relaxed during the pandemic to relieve financial burden of borrowers and maintain credit intermediation, have been strengthened gradually to be in line with domestic economic recovery and the NBC exit strategy to safeguard financial stability and rebuild a policy buffer for future needs", the NBC said. "The loan restructuring policy was withdrawn at the end of Jun 2022, and the amount of restructured loans declined from 10.5% to only 5% of total credit", the central bank added. (Source: Phnom Penh Post)

Corporate News

Lexmin to incorporate company in Cambodia Nutritional dietary food supplements maker Lexmin has decided to incorporate in Cambodia. Lexmin Pty Ltd, an Australian company, and its Cambodian branch Lexmin Pty Ltd, were founded in June 2018 as nutritional plant-food entrepreneurship to meet the affluent consumers demand in the US, Europe, Japan, Australia, and countries in Southeast Asia where health consciousness was on the rise and in the past four years, the project has accumulated a number of assets besides capitalized injections, according to a press release. Lexmin will now incorporate its branch in Cambodia as a Cambodian company and has invited Cambodian and foreign investors to take up equity up to 40% in the new company on a fair value basis. (Source: Khmer Times)

| Stock Charts |

Main Board

Growth Board