CSX index posts weekly gain of 0.54%

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 476.77 | -0.13 | 75,866 | 7,231 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,480 | 0.00 | 0.81 | 4.47 | 7,500 | 7,380 | 20,969 | 651 |

| GTI | 3,690 | -0.27 | -3.15 | -12.56 | 3,850 | 3,690 | 56,503 | 148 |

| PPAP | 14,000 | 0.00 | 0.00 | -4.76 | 14,000 | 13,940 | 2,506 | 290 |

| PPSP | 2,370 | 0.00 | 1.72 | 14.49 | 2,380 | 2,320 | 105,670 | 170 |

| PAS | 13,060 | 0.00 | 0.46 | -1.95 | 13,180 | 12,920 | 17,676 | 1,120 |

| ABC | 10,660 | -0.19 | 1.33 | 1.33 | 10,700 | 10,380 | 567,822 | 4,618 |

| PEPC | 3,140 | 0.00 | 0.00 | -0.32 | 3,150 | 3,090 | 3,866 | 235 |

| DBDE | 2,370 | 0.00 | -0.42 | 2.60 | 2,380 | 2,360 | 60,100 | 44 |

| JSL | 4,920 | -0.40 | 2.50 | NA | 4,980 | 4,760 | 47,637 | 126 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 2021U | 1,486 | 8,930 | 5.03 | 0.84 | 1.76 | 6.15 |

| GTI | 2021U | 29 | 6,987 | 126.28 | 0.53 | 0.29 | 35.63 |

| PPAP | 2021U | 2,499 | 15,972 | 5.60 | 0.88 | 2.31 | 3.63 |

| PPSP | 2021U | 112 | 3,451 | 21.23 | 0.69 | 1.45 | 8.48 |

| PAS | 2021U | 1,093 | 4,889 | 11.95 | 2.67 | 3.27 | 12.34 |

| ABC | 2,021 | 1,565 | 11,277 | 6.81 | 0.95 | 2.46 | NA |

| PEPC** | 2021U | 183 | 1,349 | 17.13 | 2.33 | 0.80 | 15.79 |

| DBDE | 2021U | 86 | 1,993 | 27.67 | 1.19 | 0.60 | 10.41 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| News Highlights |

Stock Market

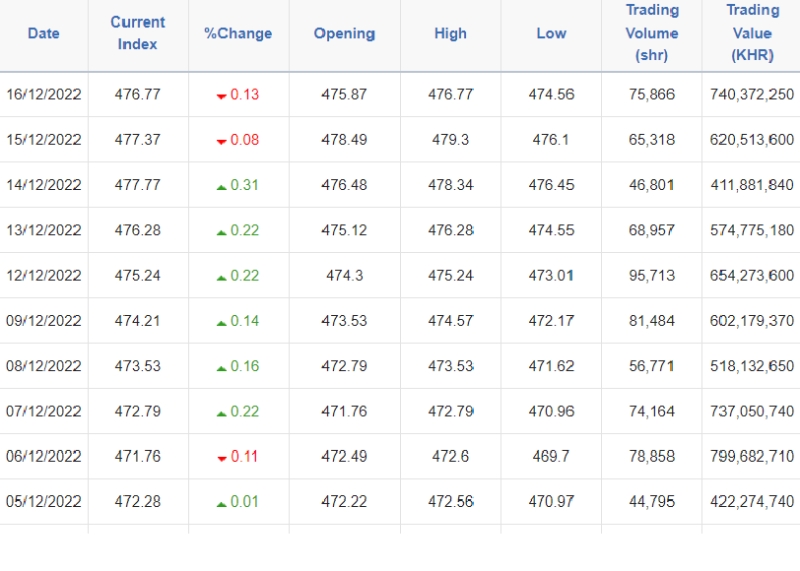

CSX index posts weekly gain of 0.54% The CSX index edged down for the second day straight, dropping 0.13% from the previous close to 476.77pts, but posting a weekly gain of 0.54%. ABC shares saw the biggest weekly gain of 0.8% to end at KHR10,660, followed by PAS shares rising 0.5% from last Friday to KHR13,060. PPWSA and PPAP gained slightly over the week to KHR7,480, and KHR14,000, respectively. PEPC shares were unchanged from last Friday, while GIT shares posted a weekly loss of 2.1%. On the growth, DBDE shares remained unmoved, while JSL shares gained 2.5%. (Source: YSC Research)

Economy and Industry

K. Speu province to have first paper mill soon Kampong Speu province's first paper mill, with registered investment capital of about $30 million, is scheduled to go online in the next four or five months, and generate some 2,000 jobs, according to provincial governor Vei Samnang on December 14. The governor said that the mill would be able to produce retail-ready paper, as opposed to just paper pulp, adding that its facilities would be equipped with state-of-the-art German machinery and that its production raw materials would be sourced from the US and Thailand--and domestically to a lesser extent. his factory will provide a bunch of benefits for the people of Kampong Speu, and play its part in boosting national economic growth, to meet the Royal Government's vision of transforming Cambodia into an upper-middle income country by 2030 and a high-income economy by 2050, he said. (Source: Phnom Penh Post)

Corporate News

PEPC and Attwood sign MOU to conduct feasibility studies on solar-based assets PESTECH (Cambodia) Plc (PEPC) and Attwood Investment Group (AIG) have signed a memorandum of understanding (MOU) to collaborate on the development of two feasibilities studies about the construction or ownership and operation of solar-based assets in Cambodia. The solar-based assets are expected to be used to provide electricity to MSP Development Co Ltd for on-sale to retail customers and Rooftop solar within the Steung Hav Special Economic Zone. The MOU will allow PEPC to contribute and strengthen its expertise in renewable energy while being committed to sustainable development, said PESTECH International Bhd. (Source: Khmer Times)

Manulife launches first digital insurance products to ABA customers Manulife Cambodia announced that it has launched the first digital insurance product called Manulife Soksabay to all customers of ABA Bank. Manulife Soksabay is an affordable financial protection plan that ABA Bank customers can purchase from Manulife easily and quickly in just one minute using the Services sector the ABA mobile app. The product comes at a very affordable price, starting from $16 per year without the need for a medical examination, and provide financial protection in the case of traffic and other types of accidents, with the protection of up to 10,000. Claim can also be made through the same Manulife digital service at the Services section of ABA mobile. (Source: Khmer Times)

Prudential and PhillTech Prudential Cambodia and Philltech--a Cambodian ICT Award winner and an online pharma marketplace--have entered a partnership that is likely to drive online insurance and healthcare access. As of the partnership, the two firms are installing innovative insurance selling machines (ISMs) within PhillTech's pharmacy network. Prudential Cambodia CEO said the ISMs will bring protection solutions to local communities. PillTech is Cambodia's first health tech start-up that focuses on improving the Kingdom’s pharmaceutical distribution networks by creating a platform to help improve medication safety and accessibility, with more than 3,000 drugs available at the click of a button. To date, PillTech has more than 2,000 pharmacies as members using its online pharma marketplace. (Source: Phnom Penh Post)

| Stock Charts |

Main Board

Growth Board