CSX index rises for sixth trading day straight

| CSX Stocks |

CSX Index

| Value | 1D % Chg | 1D Vol | Mkt Cap (KHR'bn) |

| 477.77 | 0.31 | 46,801 | 7,246 |

Stock Performance

| Stock | Close (KHR) | 1D chg (%) | MTD chg (%) | YTD chg (%) | 1M high (KHR) | 1M low (KHR) | MTD vol (shr) | Mkt cap (KHR'bn) |

| PWSA | 7,480 | 0.00 | 0.81 | 4.47 | 7,500 | 7,300 | 17,792 | 651 |

| GTI | 3,700 | -0.80 | -2.89 | -12.32 | 3,850 | 3,700 | 50,069 | 148 |

| PPAP | 13,960 | -0.14 | -0.29 | -5.03 | 14,000 | 13,940 | 2,113 | 289 |

| PPSP | 2,370 | 0.00 | 1.72 | 14.49 | 2,380 | 2,320 | 94,381 | 170 |

| PAS | 13,040 | -0.15 | 0.31 | -2.10 | 13,200 | 12,920 | 13,751 | 1,118 |

| ABC | 10,700 | 0.56 | 1.71 | 1.71 | 10,700 | 10,380 | 452,694 | 4,635 |

| PEPC | 3,140 | 0.00 | 0.00 | -0.32 | 3,150 | 3,090 | 3,028 | 235 |

| DBDE | 2,370 | 0.00 | -0.42 | 2.60 | 2,380 | 2,350 | 56,519 | 44 |

| JSL | 4,900 | 0.00 | 2.08 | NA | 4,980 | 4,760 | 46,173 | 126 |

| 1D = 1 Day; 1M= 1 Month; MTD = Month-To-Date; YTD = Year-To-Date; Chg = Change; Vol = Volume; shr = share; Mkt cap = Market capitalization | ||||||||

Valuation Ratios

| EPS | BPS* | P/E | P/B | P/S | EV/EBITDA | ||

| ttm,mrq | (ttm,KHR) | KHR | (ttm,x) | (mrq,x) | (ttm,x) | (ttm,x) | |

| PPWSA | 2021U | 1,486 | 8,930 | 5.03 | 0.84 | 1.76 | 6.15 |

| GTI | 2021U | 29 | 6,987 | 126.63 | 0.53 | 0.29 | 35.71 |

| PPAP | 2021U | 2,499 | 15,972 | 5.59 | 0.87 | 2.31 | 3.62 |

| PPSP | 2021U | 112 | 3,451 | 21.23 | 0.69 | 1.45 | 8.48 |

| PAS | 2021U | 1,093 | 4,889 | 11.94 | 2.67 | 3.27 | 12.32 |

| ABC | 2,021 | 1,565 | 11,277 | 6.84 | 0.95 | 2.47 | NA |

| PEPC** | 2021U | 183 | 1,349 | 17.13 | 2.33 | 0.80 | 15.79 |

| DBDE | 2021U | 86 | 1,993 | 27.67 | 1.19 | 0.60 | 10.41 |

| NOTE: ttm= trailing-twelve months; mrq = most recent quarter; *Excluding equity of non-common shares for PPWSA, PPAP and PAS; **FY ending in June | |||||||

| News Highlights |

Stock Market

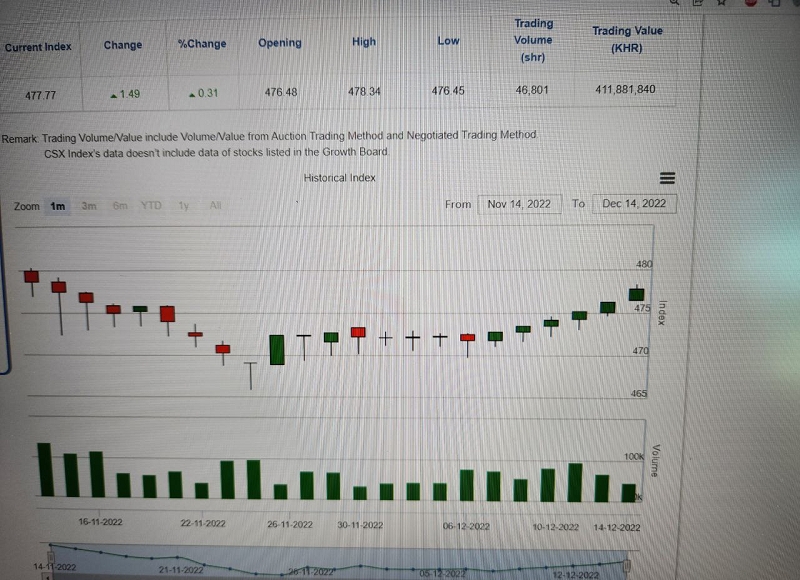

CSX index rises for sixth trading day straight The CSX index rose for the sixth trading day straight, up 0.31% from the previous close to 477.8pts. The heavyweight ABC saw the biggest daily gain in the last 13 trading days, advancing another 0.56% from yesterday to end at a one-month high of KHR10,700. GTI, PPAP and PAS shares, however, edged down 0.80%, 0.14%, and 0.15% to KHR3,700, KHR13,960, and KHR13,040, respectively. PPWSA, PPSP, PEPC, DBDE, and JSL shares remained unchanged. (Source: YSC Research)

Economy and Industry

Credit to private sector reach $53.1bn as of Jun 2022 Total outstanding loans extended by banking and financial institutions to the private sector in all economic sectors grew 23.6% YoY in the first half of 2022 to reach KHR 216tn or $53.1bn, according to the National Bank of Cambodia (NBC). By sector, construction (including real estate activities and mortgage) accounted for KHR 58.4tn, up 30% YoY, followed by the wholesale and retail trade with KHR 53.5tn, up 25.6% YoY, services (KHR 21.3tn; +14.5% YoY), agriculture (KHR 20.3tn; +24.6% YoY), household (KHR 11.7tn; +12.1% YoY), and manufacturing (KHR 7.2tn; + 12.1% YoY), with the remainder receiving KHR 43.6bn, up 20.7% YoY. (Source: Khmer Times)

Cambodia signs $1.22bn concessional loans in first nine months Cambodia signed almost $1.22bn in new concessional loans with Development Partner (DP) in the first nine months of the year, of which bilateral DPs accounted for 68%, according to the latest Cambodia Public Debt Statistical Bulletin issued by the Ministry of Economy and Finance. The concession loans signed during the period correspond to SDR 950mn (exchange rate of SDR 0.78 per USD) or 59% of the one-year ceiling of SDR 1.6bn permitted by law. All loans are highly concessional with an average grant element of around 42%, said the MEF, adding that the purpose of these new loans is to finance public investment projects in the priority sectors that support long-term sustainable economic growth and increase productivity. As of Sep 2022, the government had a total of public debt of $9.47bn, with public domestic and external debt making up $10.15mn and $9.46bn, respectively, according to the bulletin. Hong Vanak, director of International Economics at the Royal Academy of Cambodia, said that the recent concessional loans have gone into sustainable, legally compliant, and transparent projects that deliver on their commitments, as part of broader long-term development plans. (Source: Phnom Penh Post)

Cambodia's exports increase 18% YoY in first 11 months Cambodia's exports of goods to the world market reached $20.46bn in the first 11 months of the year, an increase of 18% YoY, according to a report of the General Department of Customs and Excise (GDCE). The largest buyer of Cambodia's products was the US, followed by Vietnam, China, Japan, Canada, and Germany, the report read. Cambodia's major exports include garments, footwear, travel goods, bicycles, electrical and electronic appliances, pharmaceuticals, agriculture products, and so on. Meanwhile, the country imported $27.75bn worth of goods, up 9.2% YoY, according to the report. (Source: Khmer Times)

Corporate News

Angkor Resources Corp. confirms copper/gold porphyry system on its license Angkor Resources Corp. has announced that assays from its Andong Bor license confirm a copper gold porphyry system on the prospect. The Andong Bor license is due west of Ratanakiri province and straddles two provinces, Oddar Meanchey and Banteay Meanchey. A geological team reviewed, logged, and assayed selected core from license area drilled in 2016 by the previous license holders. A 108-metre interval from 282 to 390 meters consists of predominantly well mineralized potassic altered mudstone with a 21-metre interval of "crowded porphyry" diorite. The 108-metre interval has a copper equivalent grade of 0.53%. (Source: Khmer Times)

| Stock Charts |

Main Board

Growth Board